Key Takeaways

Understanding what makes an estate “large” in Florida is critical for families facing probate. Here are the essential points:

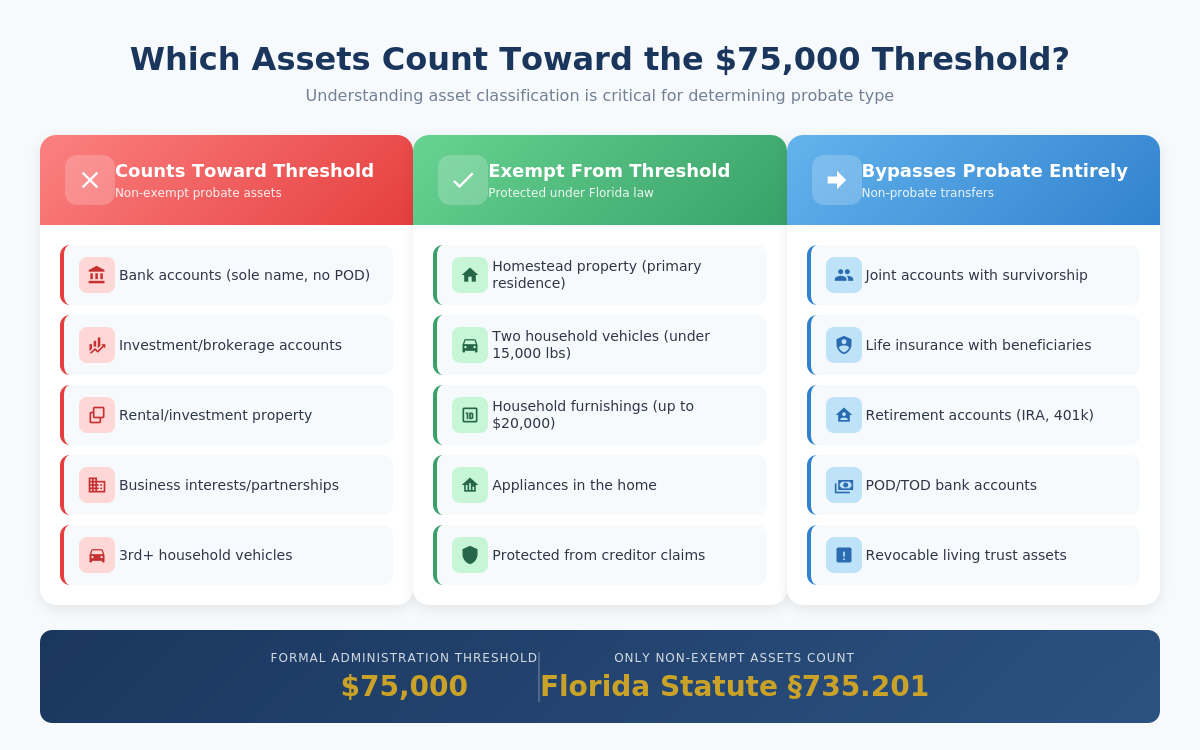

- The $75,000 threshold determines probate type. Under Florida Statute §735.201, estates with non-exempt assets exceeding $75,000 require formal administration.

- Only non-exempt assets count toward this threshold. Homestead property, two vehicles, and household furnishings up to $20,000 are excluded from the calculation.

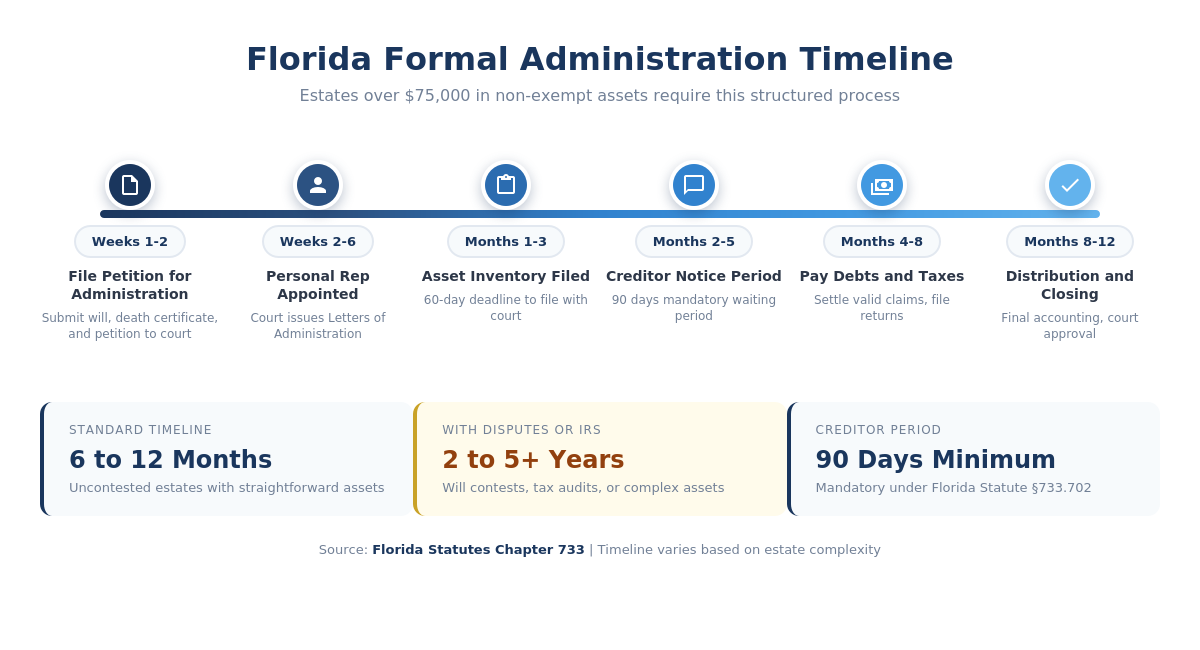

- Formal administration takes 10 to 12 months minimum. Complex estates involving disputes or IRS involvement extend this timeline to 2 to 5 years.

- Florida has no state estate tax or inheritance tax. Federal estate taxes only apply to estates exceeding $15 million per individual ($30 million for married couples) as of 2026.

- A personal representative must be appointed for large estates. This court-supervised process requires attorney involvement under Florida law.

- Non-probate assets bypass the threshold calculation entirely. Retirement accounts with beneficiaries, jointly owned property, and trust assets transfer outside probate.

- Professional appraisals are required for complex assets. Real estate, business interests, and collectibles need formal valuation at fair market value as of the date of death.

- Early planning saves time and money. Families who engage probate attorneys at the start avoid costly delays and procedural errors.

Introduction

When a loved one passes away in Florida, one of the first questions families face is: “How complicated will this probate process be?”

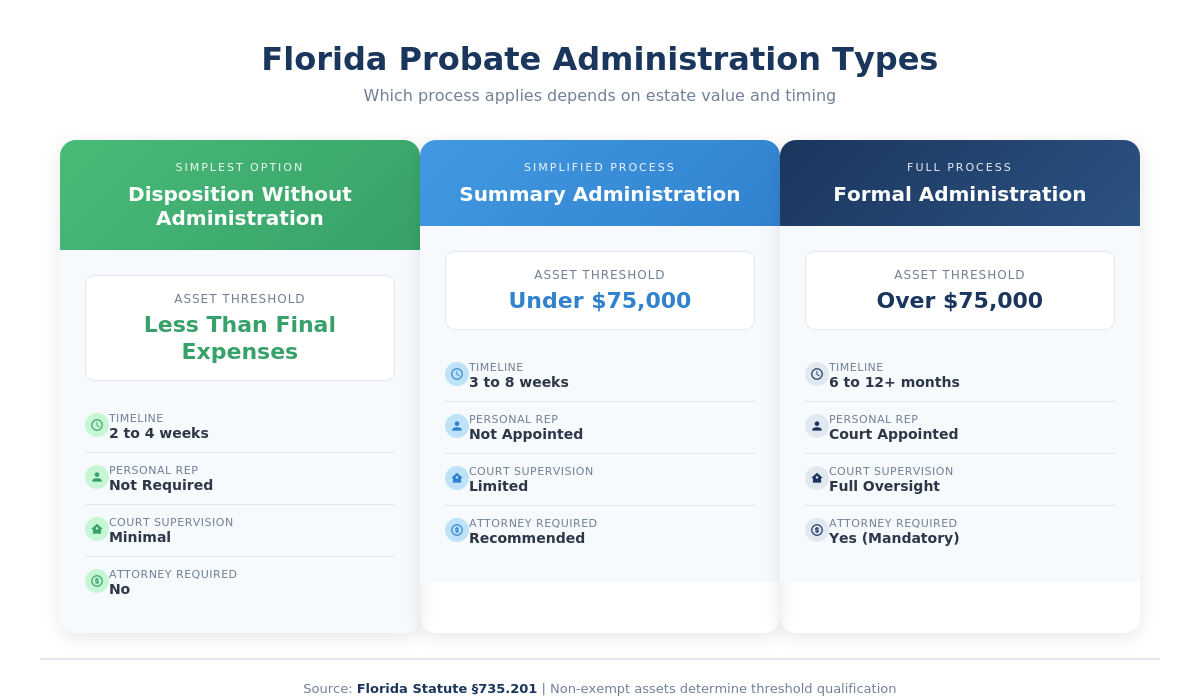

The answer depends on estate size. Florida law divides probate into two categories: summary administration for smaller estates and formal administration for larger ones. The dividing line sits at $75,000 in non-exempt assets.

This threshold matters because formal administration requires court supervision, strict deadlines, and attorney involvement. The process takes longer, costs more, and demands careful attention to creditor claims, asset inventories, and tax filings.

If you are managing an estate with multiple properties, investment accounts, or business interests, you face a set of questions that need clear answers:

- Does the estate qualify for simplified probate, or is formal administration required?

- Which assets count toward the $75,000 threshold?

- What steps must the personal representative complete?

- How long will the process take, and what will it cost?

This guide breaks down what constitutes a large probate estate in Florida and provides practical steps to handle the process efficiently. For comprehensive guidance on large estate probate services, our team is here to help.

What is the Legal Definition of a Large Probate Estate in Florida?

Under Florida Statute §735.201, a “large” probate estate is one that exceeds $75,000 in non-exempt assets and requires formal administration.

Florida recognizes three types of probate proceedings:

| Probate Type | Asset Threshold | Timeline | Court Supervision |

| Disposition Without Administration | Assets less than final expenses | 2 to 4 weeks | Minimal |

| Summary Administration | Non-exempt assets under $75,000 OR death occurred more than 2 years ago | 3 to 8 weeks | Limited |

| Formal Administration | Non-exempt assets exceed $75,000 AND death within 2 years | 10 to 12 months (minimum) | Full |

Figure 1: Florida Probate Types and Thresholds Source: Florida Bar Consumer Pamphlet, January 2025

The $75,000 threshold applies only to non-exempt assets subject to probate administration. This distinction is critical because many families assume their total net worth determines probate complexity. In practice, the calculation excludes significant asset categories.

Which Assets Count Toward the $75,000 Probate Threshold?

Only non-exempt probate assets count toward the $75,000 threshold that triggers formal administration.

Assets That Count (Non-Exempt Probate Assets)

These assets increase your probate estate value:

- Bank accounts solely in the decedent’s name without payable-on-death (POD) beneficiaries

- Investment and brokerage accounts titled in the decedent’s sole name

- Stocks, bonds, and mutual funds without transfer-on-death (TOD) designations

- Real estate (other than protected homestead) titled in the decedent’s name alone, or held as tenants-in-common with another person

- Rental or investment properties

- Business interests and partnership shares

- Vehicles beyond the two-vehicle exemption or vehicles used for business purposes

- Personal property valued above exempt thresholds

- Intellectual property (patents, copyrights, trademarks)

- Cryptocurrency and digital assets held in individual accounts

Assets That Do Not Count (Exempt Assets)

Under Florida Statute §732.402 and the Florida Constitution Article X, Section 4, these assets are exempt from creditor claims and excluded from the $75,000 calculation:

- Homestead property (the decedent’s primary residence meeting constitutional requirements)

- Two motor vehicles used regularly by household members (each under 15,000 pounds)

- Household furniture, appliances, and furnishings up to $20,000 in value

Assets That Bypass Probate Entirely

These non-probate assets do not count toward the threshold because they transfer automatically to named beneficiaries:

- Jointly owned property with rights of survivorship

- Life insurance policies with named beneficiaries

- Retirement accounts (401(k), IRA) with beneficiary designations

- Payable-on-death (POD) bank accounts

- Transfer-on-death (TOD) brokerage accounts

- Assets held in revocable living trusts

| Asset Type | Counts Toward Threshold? | Requires Probate? |

| Homestead property | No | Yes (for title transfer) |

| Bank account (sole name, no POD) | Yes | Yes |

| IRA with named beneficiary | No | No |

| Rental property (sole name) | Yes | Yes |

| Joint bank account with survivorship | No | No |

| Vehicle (1 of 2 household vehicles) | No | No |

| Third household vehicle | Yes | Yes |

Figure 2: Asset Classification for Florida Probate Threshold

How Do You Calculate the Value of a Probate Estate?

Calculating estate value for probate purposes requires assessing each asset at fair market value as of the date of death.

Valuation Methods by Asset Type

Cash and Bank Accounts The value equals the account balance on the date of death. Personal representatives obtain account statements from financial institutions.

Publicly Traded Securities Stocks and mutual funds are valued using the average of high and low trading prices on the date of death. Brokerage statements provide these figures.

Real Estate Real property requires professional appraisal based on comparable sales in the area. The <a href=”https://homevalueinc.com/valuing-probate-property-florida/”>market approach</a> analyzes recent sales of similar properties to determine fair market value.

Business Interests Business valuations require CPAs or forensic accountants to assess going-concern value, asset value, or income potential. These appraisals are complex and necessary for estates with ownership stakes in companies.

Personal Property and Collectibles Items valued at $50,000 or more require professional appraisal. The IRS Art Advisory Panel reviews artwork and collectibles in larger estates. For lower-value items, personal representatives compare similar items sold online or at auction.

Vehicles Standard vehicles are valued using resources like Kelley Blue Book. Classic or collectible vehicles require professional appraisals.

Net Value Calculation

The probate estate value equals gross assets minus:

- Outstanding mortgages and secured debts on probate property

- Liens attached to probate assets

- The decedent’s proportional share of jointly owned property (if any portion passes through probate)

What is the Difference Between Summary and Formal Administration?

The type of administration determines the complexity, cost, and timeline of probate.

Summary Administration

Florida Statute §735.201 permits summary administration when:

- Non-exempt assets total $75,000 or less, OR

- The decedent has been dead for more than 2 years

Key Features:

- No personal representative appointed

- Single court order distributes assets

- Timeline of 3 to 8 weeks in most cases

- Lower legal fees (flat-fee arrangements common)

- Filing fees between $235 and $400

- All beneficiaries must consent or receive formal notice

- Creditor claims must be paid or all creditors must consent

Limitations:

- Cannot be used for litigation on behalf of the estate

- Cannot investigate unknown assets

- Not available if the will directs formal administration

Formal Administration

Estates exceeding $75,000 in non-exempt assets (for deaths within the past 2 years) require formal administration under Florida Statutes Chapter 733.

Key Features:

- Court appoints a personal representative

- Personal representative has authority to manage all estate affairs

- Mandatory creditor notification period (90 days from publication)

- Required asset inventory filed within 60 days of appointment

- Final accounting required before distribution

- Timeline of 6 to 12 months minimum

- Attorney representation mandatory under Florida law

| Feature | Summary Administration | Formal Administration |

| Personal Representative | Not appointed | Court appointed |

| Creditor Notice Period | Not required | 90 days mandatory |

| Timeline | 3 to 8 weeks | 6 to 12 months |

| Attorney Fees | Lower (flat fee typical) | Higher (percentage or hourly) |

| Court Supervision | Limited | Full oversight |

| Asset Investigation | Not available | Full authority |

| Litigation Authority | Not available | Full authority |

Figure 3: Summary vs. Formal Administration Comparison

What Does Formal Administration Require?

Formal administration involves a structured process with specific legal requirements.

Step 1: Filing the Petition for Administration (Weeks 1 to 2)

The process begins when a family member or the person named in the will files a Petition for Administration with the Circuit Court in the county where the decedent resided.

Required documents include:

- Original will (if one exists)

- Certified death certificate

- List of known beneficiaries and their addresses

- Statement of the personal representative’s qualifications

Step 2: Personal Representative Appointment (Weeks 2 to 6)

The court reviews the petition and appoints a personal representative. This individual receives Letters of Administration granting legal authority to act on behalf of the estate.

Personal representative responsibilities include:

- Locating and securing all estate assets

- Opening an estate bank account

- Notifying beneficiaries of the administration

- Publishing notice to creditors

- Filing asset inventory with the court

- Paying valid debts and taxes

- Distributing remaining assets according to the will or intestacy laws

Step 3: Creditor Notification Period (Months 2 to 5)

Under Florida Statute §733.2121, the personal representative must:

- Publish a Notice to Creditors in a local newspaper

- Send direct notice to all known creditors

- Allow 90 days from publication (or 30 days from direct notice) for claims

Step 4: Asset Inventory and Valuation (Months 1 to 3)

The personal representative must file an inventory of all probate assets within 60 days of appointment. This inventory lists each asset and its fair market value as of the date of death.

Step 5: Debt Payment and Tax Filings (Months 4 to 8)

Valid creditor claims are paid from estate assets in the order of priority established by Florida law. The personal representative files any required tax returns:

- Decedent’s final income tax return (Form 1040)

- Estate income tax return (Form 1041) if estate income exceeds $600

- Federal estate tax return (Form 706) if the estate exceeds $15 million (2026 threshold)

Step 6: Distribution and Closing (Months 8 to 12)

After debts, taxes, and expenses are paid, the personal representative:

- Prepares a final accounting

- Proposes distribution to beneficiaries

- Files a Petition for Discharge with the court

- Obtains court approval to close the estate

What Are the Costs of Formal Administration for Large Estates?

Probate costs consume a percentage of estate value. Understanding these expenses helps families plan appropriately.

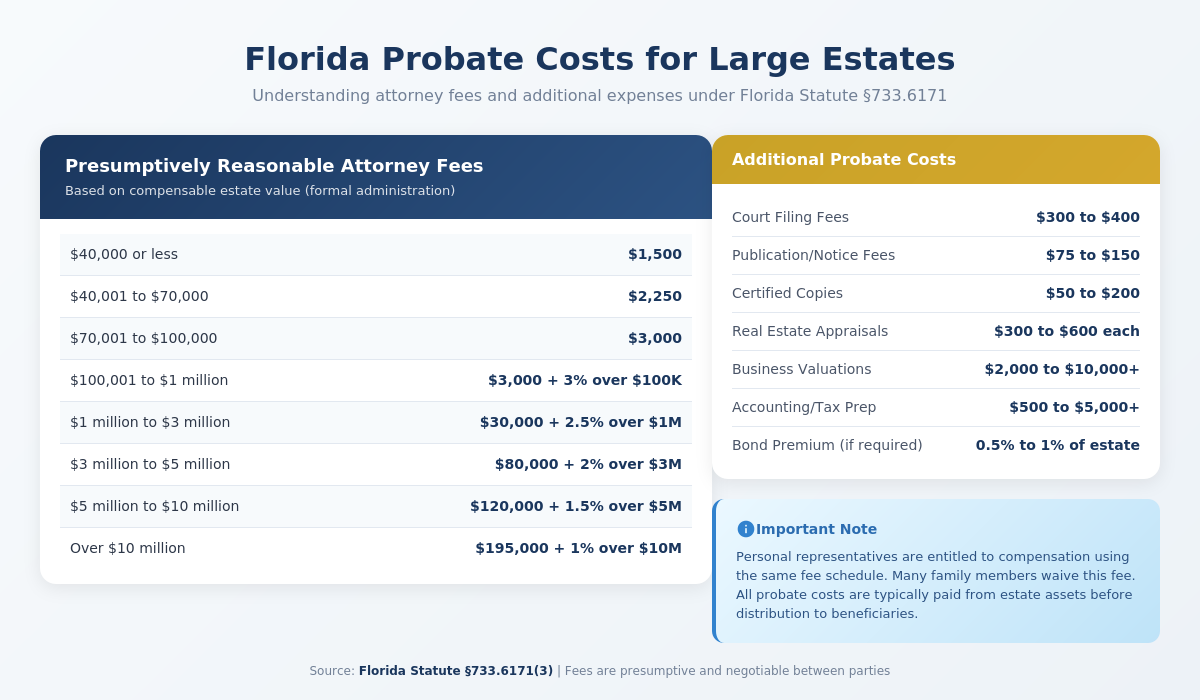

Attorney Fees

Florida Statute §733.6171 establishes presumptively reasonable attorney fees based on estate value:

| Estate Value | Presumptively Reasonable Fee |

| $40,000 or less | $1,500 |

| $40,001 to $70,000 | $2,250 |

| $70,001 to $100,000 | $3,000 |

| $100,001 to $1 million | $3,000 plus 3% of value over $100,000 |

| $1 million to $3 million | $30,000 plus 2.5% of value over $1 million |

| $3 million to $5 million | $80,000 plus 2% of value over $3 million |

| $5 million to $10 million | $120,000 plus 1.5% of value over $5 million |

| Over $10 million | $195,000 plus 1% of value over $10 million |

Figure 4: Florida Statutory Attorney Fee Schedule Source: Florida Statute §733.6171(3)

Important: These fees are presumptive, not mandatory. Attorneys and personal representatives can negotiate different arrangements. Fees must be reasonable under the circumstances.

Personal Representative Compensation

Personal representatives are entitled to compensation using the same statutory schedule as attorneys. Many family members serving as personal representatives waive this fee.

Additional Costs

| Expense Category | Typical Range |

| Court filing fees | $300 to $400 |

| Publication/Notice fees | $75 to $150 |

| Certified copies | $50 to $200 |

| Real estate appraisals | $300 to $600 per property |

| Business valuations | $2,000 to $10,000+ |

| Accounting/Tax preparation | $500 to $5,000+ |

| Bond premiums (if required) | 0.5% to 1% of estate value |

Figure 5: Additional Probate Costs for Large Florida Estates

How Long Does Formal Administration Take?

Standard formal administration takes 6 to 12 months for uncontested estates. Multiple factors extend this timeline.

Standard Timeline

| Phase | Timeframe |

| Filing petition and appointment | 2 to 6 weeks |

| Asset inventory and valuation | 1 to 3 months |

| Creditor claim period | 3 to 4 months (mandatory minimum) |

| Debt payment and tax filings | 1 to 2 months |

| Distribution and closing | 1 to 2 months |

| Total (uncontested) | 6 to 12 months |

Factors That Extend Timeline

Family Disputes Will contests, undue influence claims, or disagreements over asset distribution add months or years to probate. Litigation requires additional court hearings and discovery.

Complex Assets Business interests, intellectual property, or international assets require extended valuation periods and specialized expertise.

IRS Involvement Estates requiring Form 706 (federal estate tax return) must remain open until the IRS issues a closing letter. This adds 9 to 18 months after filing.

Real Estate in Multiple States Property outside Florida requires ancillary probate in each state, adding separate court proceedings and legal fees.

Missing Documents or Unknown Assets Investigation into the decedent’s financial affairs extends timelines when records are incomplete.

What Triggers Federal Estate Tax Requirements?

While Florida has no state estate tax, federal estate taxes apply to larger estates.

Federal Estate Tax Exemption (2025 to 2026)

| Year | Individual Exemption | Married Couple (Combined) |

| 2025 | $13.99 million | $27.98 million |

| 2026 and beyond | $15 million | $30 million |

Source: IRS Form 706 Instructions (September 2025)

The One Big Beautiful Bill Act made the $15 million exemption permanent starting January 1, 2026, with inflation indexing beginning in 2027.

Form 706 Requirements

Estates exceeding the exemption threshold must file Form 706 within 9 months of death (15 months with extension). The 40% federal estate tax applies to amounts exceeding the exemption.

Portability Election Surviving spouses preserve unused exemption amounts by filing Form 706 for the deceased spouse’s estate, even if no tax is owed. This election allows a surviving spouse to claim up to $30 million in combined exemption.

How Can Families Reduce Probate Complexity?

Strategic planning reduces the assets subject to formal administration.

Pre-Death Planning Tools

Revocable Living Trusts Assets transferred to a properly funded trust bypass probate entirely. The trustee distributes assets according to trust terms without court involvement.

Beneficiary Designations Retirement accounts, life insurance policies, and bank accounts with POD/TOD designations transfer directly to named beneficiaries.

Joint Ownership with Survivorship Rights Property titled as joint tenants with rights of survivorship passes automatically to the surviving owner.

Lady Bird Deeds (Enhanced Life Estate Deeds) These deeds transfer homestead property to named remaindermen while allowing the owner to retain control during their lifetime.

Post-Death Strategies

Timing of Probate Filing If the decedent died more than 2 years ago, summary administration is available regardless of estate value under Florida Statute §735.201.

Identifying Exempt Assets Careful analysis ensures homestead property, vehicles, and household furnishings are properly excluded from the threshold calculation.

Locating Beneficiary Designations Reviewing account documents identifies assets that bypass probate, reducing the formal administration burden.

Frequently Asked Questions

1. What is the probate threshold in Florida?

The probate threshold in Florida is $75,000 in non-exempt assets. Estates below this threshold qualify for summary administration, a simplified process. Estates exceeding $75,000 in non-exempt assets (for deaths within 2 years) require formal administration with full court supervision.

2. What assets are excluded from the $75,000 probate threshold?

Florida excludes homestead property, two household vehicles, and household furnishings up to $20,000 from the probate threshold calculation. Assets with beneficiary designations (life insurance, retirement accounts, POD/TOD accounts) and jointly owned property with survivorship rights bypass probate entirely and are not counted.

3. How long does formal probate take in Florida?

Formal probate takes 6 to 12 months for straightforward estates. The mandatory 90-day creditor period establishes the minimum timeline. Complex estates with disputes, IRS involvement, or out-of-state property can extend to 2 to 5 years or longer.

4. Does Florida have an estate tax?

No. Florida does not have a state estate tax or inheritance tax. The Florida Constitution prohibits these taxes. Federal estate taxes apply only to estates exceeding $15 million per individual ($30 million for married couples) as of 2026.

5. What happens if an estate exceeds $75,000 in non-exempt assets?

Estates exceeding $75,000 in non-exempt assets (where death occurred within 2 years) require formal administration. The court appoints a personal representative who manages the estate under court supervision, notifies creditors, inventories assets, pays debts, and distributes remaining property to beneficiaries.

6. Who can serve as personal representative in Florida?

Florida requires personal representatives to be either a Florida resident or a close relative (spouse, parent, child, sibling) of the decedent. The person must be at least 18 years old and mentally competent. Convicted felons and those found unsuitable by the court are disqualified.

7. Are attorney fees required for Florida probate?

Florida law requires attorney representation for formal administration. Attorneys are not mandatory for summary administration, though most families hire legal counsel to ensure proper filing. Attorney fees follow a statutory schedule based on estate value, though negotiated arrangements are permitted.

8. How is real estate valued for probate purposes?

Real estate is valued at fair market value as of the date of death. Personal representatives obtain professional appraisals based on comparable sales in the area. Appraisers assess property condition, location, and recent market transactions to determine value.

9. Can probate be avoided in Florida?

Probate can be minimized or avoided through estate planning tools including revocable living trusts, beneficiary designations on financial accounts, joint ownership with survivorship rights, and Lady Bird deeds for homestead property. Assets using these methods bypass probate and transfer directly to beneficiaries.

10. What if the decedent owned property in multiple states?

Property located outside Florida requires ancillary probate in each state where real estate is located. This involves separate court proceedings, additional legal fees, and extended timelines. Proper estate planning (such as placing out-of-state property in trusts) avoids this complication.

Protecting Your Family Is a Phone Call Away

Understanding what constitutes a large probate estate in Florida helps families prepare for the process ahead. The $75,000 threshold determines whether your loved one’s estate qualifies for simplified procedures or requires formal court supervision.

The estate planning attorneys at SJF Law Group guide families through Florida probate and help minimize complexity through strategic planning. When you work with our team, you receive clear guidance on estate valuation, creditor management, and efficient administration.

Call us at 954-580-3690 or email info@estateandprobatelawyer.com today.