Have you ever wondered what happens if a decedent owned property in multiple states?

Exactly how would probate of the property be handled if the property the decedent owned wasn’t located in the state where the decedent passed away?

Given the fact that real property is governed by the laws of the state in which it is located, owning property in multiple states can cause serious probate complications.

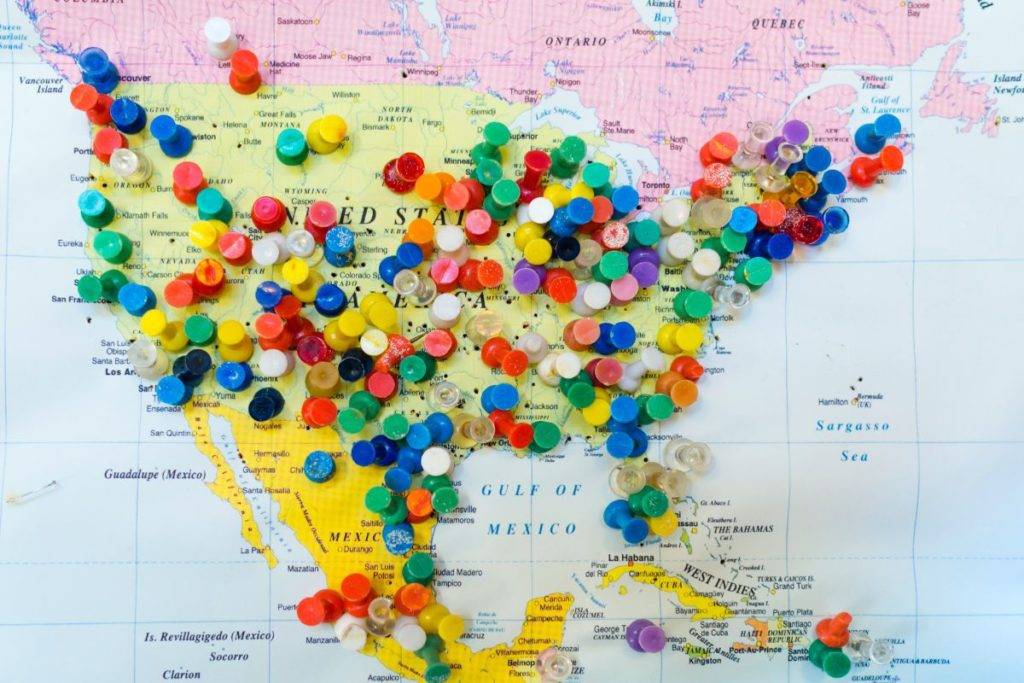

And yet, this is something we see all the time. Owning property in multiple states is fairly common.

Especially in states like Florida, where a significant amount of the population are “snowbirds” —individuals who spend the winter months in Florida and the summer months somewhere else (like New York or New Jersey).

Plus, states like Florida constantly have people moving in who may still own property elsewhere. In fact, according to reports, between April of 2020 and April of 2021, almost 330,000 people moved to Florida.

Of course, this isn’t very surprising given Florida’s attractions —beaches, warm temperatures, and the fact that it is one of only nine states that has no state income tax.

The lack of a state income tax makes Florida very attractive to affluent and lower-income families alike.

For example, the more affluent families from New York and New Jersey can escape (the cold and) individual income tax rates of 10.9% (New York) and 10.75% (New Jersey).

Along with no state income tax, Florida has abundant job opportunities and low cost of living which makes it very attractive to lower-income families.

All of which is to say that it is not unusual for a decedent who dies in Florida to own property in another state.

But it does cause probate complications. So if you live in Florida, but own property in another state, consult with an experienced probate lawyer.

How, then, is probate handled when a decedent owned property in multiple states?

Let’s see.

Multiple Properties in Multiple States Means Multiple Probates

The short answer is that probate will have to be conducted in each state where the decedent owned property.

Which state will be the main probate action, and which will be the one in which an ancillary action is conducted, depends on where the decedent was domiciled at the time of death.

In other words, in situations like this, the first step is to determine where the decedent was domiciled. A person’s domicile is the place where he lives or has his permanent home.

The decedent’s domicile will determine where the main probate proceeding (i.e., the “domiciliary probate”) will take place. For example, if Florida is the place of the decedent’s domicile, then the domiciliary probate would be conducted in Florida, and an ancillary proceeding would be conducted in the state where the decedent owned real property but was not domiciled.

If a decedent owned Florida real property and Florida is not the decedent’s place of domicile, then the ancillary proceedings would take place in Florida according to its laws.

The domiciliary probate proceeding will control disposing of all property located in that state—including all real property.

Real property owned in a state other than the one where the decedent was domiciled will have to be disposed of through an ancillary proceeding brought in that state. Any ancillary proceedings will be conducted according to the laws of the state in which the proceeding is being held.

So, owning multiple properties in multiple states means that multiple probates will have to be conducted at the time of the decedent’s death.

Multiple probates mean significant time and cost expenditures, as well as complications and headaches.

Probate is never a process that one wants to have to undertake, so having to conduct two or more can be a veritable nightmare.

Can multiple probates for property owned in multiple states be avoided?

Yes.

There are a number of estate planning strategies that can be put in place before the issue arises. If you take the time to work with a probate lawyer to plan ahead, you can avoid such complications.

Planning ahead with the assistance of a probate lawyer can save your loved ones considerable time, money and stress.

Estate Planning With You in Mind

Our team here at SJF Law Group works hard to ensure that your wishes will be followed, and your loved ones taken care of when you are gone. Our estate planning lawyers expertly guide individuals and families through the complex probate process and capably handle all aspects of the creation, administration, and settlement of estates and trusts. When you work with our Florida estate planning attorneys at SJF Law Group, you get more than just an estate plan: you get peace of mind.

As trusted probate and estate planning lawyers, we serve clients in the vibrant communities of Plantation, Fort Lauderdale, Boca Raton, West Palm Beach, and Miami, FL. We are also pleased to offer the options of both in-person and virtual appointments throughout Florida to make our services accessible no matter where you are located.

If you want to discuss your specific situations with one of our estate planning lawyers, do not hesitate to reach out to our law firm at 954-580-3690. You can also fill out our contact form.