Key Takeaways

Managing a large probate estate in Florida requires legal representation in most cases. Here are the essential points about probate attorneys and their role:

- Florida Probate Rule 5.030 requires attorney representation. Every personal representative must be represented by an attorney admitted to practice in Florida, unless the personal representative is the sole interested person in the estate.

- Formal administration is mandatory for estates over $75,000. Under Florida Statute §735.201, estates exceeding this threshold require full court supervision and attorney involvement, unless the decedent has been dead for over 2 years.

- Attorney fees follow a statutory schedule. Florida Statute §733.6171 provides a presumptively reasonable fee structure based on estate value, starting at $1,500 for estates under $40,000 and scaling up to 3% for estates between $100,000 and $1 million. The fee percentage is reduced after $1 million

- Attorneys handle both ordinary and extraordinary services. Ordinary services include court filings, creditor notices, and asset distribution. Extraordinary services cover litigation, tax planning, and complex asset valuation.

- Probate attorneys protect personal representatives from liability. Missing deadlines, improper creditor notification, or asset mismanagement expose personal representatives to personal liability. An attorney helps avoid these risks.

- Legal guidance saves time and money in the long run. Estates with proper legal representation typically close faster and with fewer complications than those where families attempt to handle complex matters without professional support.

- Tax planning requires specialized knowledge. Large estates face potential federal estate tax obligations, income tax returns, and state-specific requirements that probate attorneys coordinate with CPAs and financial advisors.

- Attorneys mediate family disputes. Conflicts among beneficiaries arise frequently in high-value estates. A probate attorney serves as a neutral third party to resolve disagreements before they escalate to litigation.

Introduction

When a loved one passes away, the task of managing their estate falls to the personal representative. For estates valued over $75,000 in Florida, this responsibility requires formal probate administration with mandatory attorney representation under Florida Probate Rule 5.030.

The personal representative must handle court filings, creditor notifications, asset inventories, tax returns, tax elections, and final distributions to beneficiaries. Each task carries strict deadlines and legal requirements. One missed deadline or procedural error creates delays, additional costs, or personal liability for the representative.

Florida law recognizes this complexity. The state requires attorney involvement for formal administration precisely because the process demands specialized legal knowledge that most families do not possess.

If you are serving as a personal representative for a large probate estate in Florida, understanding the role of your attorney helps you work together effectively. This guide explains what probate attorneys do, when their involvement is mandatory, how their fees work, and what services they provide during estate administration.

Why Does Florida Law Require Attorney Representation in Probate?

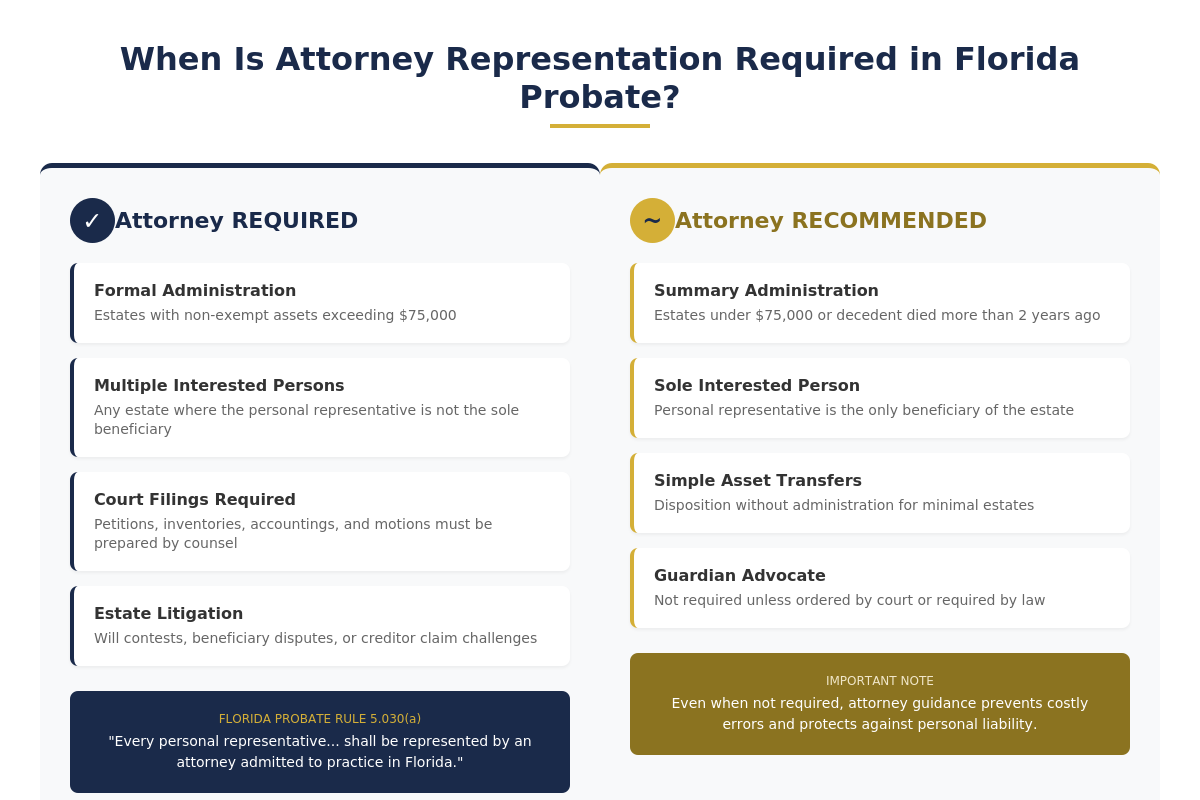

Florida Probate Rule 5.030(a) states that every personal representative “shall be represented by an attorney admitted to practice in Florida” unless the personal representative remains the sole interested person in the estate (Florida Probate Rules).

This requirement exists for several reasons:

- Probate involves court proceedings with specific procedural rules

- Personal representatives have fiduciary duties to beneficiaries and creditors

- Errors in administration create legal liability for the representative

- Florida courts require attorneys to prepare and file probate documents

- Complex assets, tax obligations, tax elections, and creditor claims demand legal expertise

The “sole interested person” exception applies only when the personal representative is the only beneficiary of the estate. In practice, most estates have multiple beneficiaries, making attorney representation mandatory.

Figure 2: Attorney representation requirements under Florida Probate Rule 5.030

Figure 2: Attorney representation requirements under Florida Probate Rule 5.030

What Happens If You Try to Proceed Without an Attorney?

Florida courts will not accept filings from non-attorney personal representatives in formal administration cases. Attempting to proceed without counsel results in:

- Rejected court filings

- Delayed administration

- Potential removal as personal representative

- Risk of personal liability for improper actions

Even in situations where attorney representation is technically optional, the complexity of probate law makes professional guidance advisable.

What Types of Probate Administration Exist in Florida?

Florida provides two primary forms of probate administration, each with different requirements for attorney involvement.

Formal Administration

Formal administration is required when:

- Non-exempt estate assets exceed $75,000

- The decedent died less than two years ago

- A personal representative is needed to handle estate matters

Under formal administration, the court closely supervises every step of the process. The personal representative must file detailed accountings, notify creditors properly, and obtain court approval for distributions.

Florida Statute §735.201 sets the threshold for formal administration. For estates meeting this threshold, attorney representation is mandatory under Rule 5.030.

Summary Administration

Summary administration is available when:

- Non-exempt estate assets total $75,000 or less

- The decedent died more than two years ago

- Creditors have been paid or no creditors exist

Summary administration provides a shorter, less expensive process. Attorney representation is not strictly required but remains advisable given the legal complexity involved.

Table 1: Florida Probate Administration Types

| Administration Type | Asset Threshold | Attorney Required | Typical Timeline |

| Formal Administration | Over $75,000 in non-exempt assets | Yes (Rule 5.030) | 10 to 12 months |

| Summary Administration | $75,000 or less in non-exempt assets | Recommended but not mandatory | 1 to 3 months |

| Disposition Without Administration | Minimal assets, only exempt property | Not required | Weeks |

Source: Florida Statutes §735.201; Florida Probate Rule 5.030

What Services Do Probate Attorneys Provide?

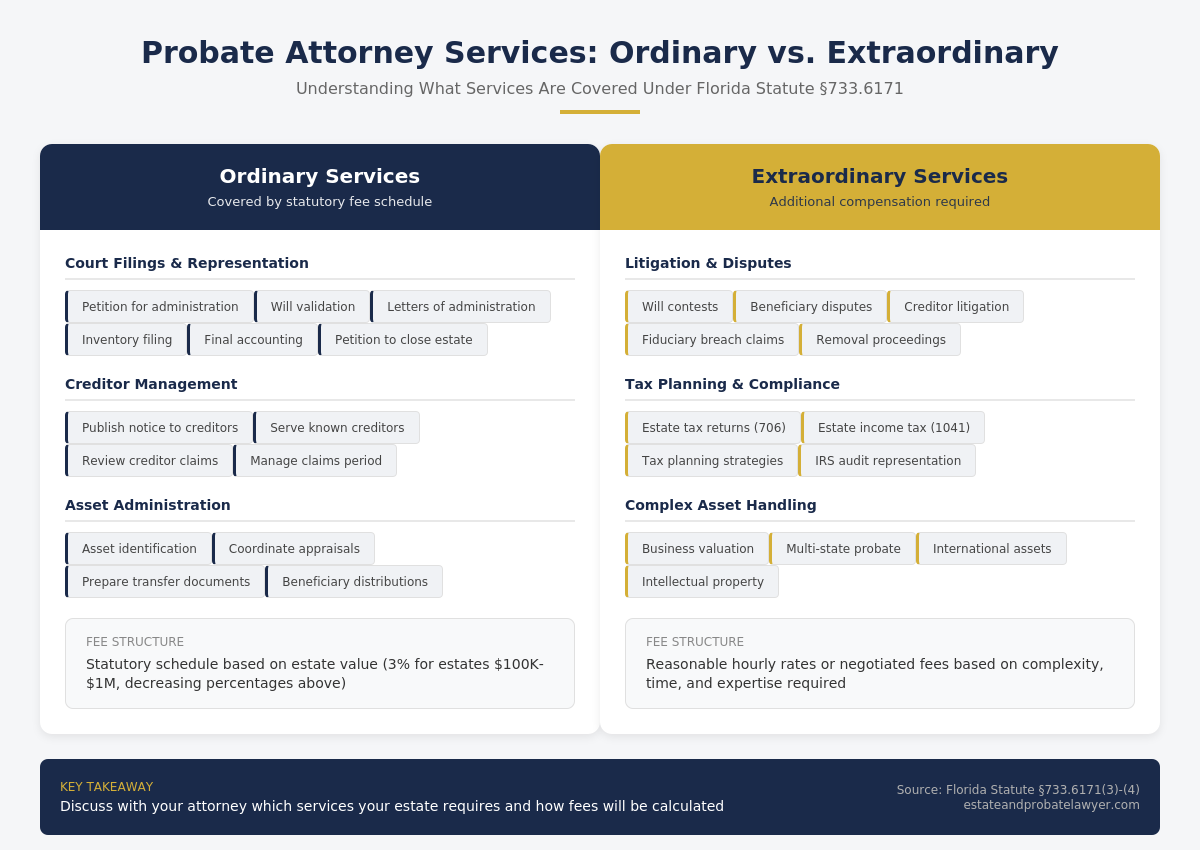

Probate attorneys handle two categories of services: ordinary services required for standard estate administration and extraordinary services for complex situations.

Ordinary Services

The Florida Probate Code defines ordinary services as tasks required in every formal administration (Florida Statute §733.6171):

Court Filings and Representation

- Filing the petition for administration with the probate court

- Submitting the will for validation

- Preparing letters of administration

- Filing inventories and accountings

- Attending required hearings

- Filing the petition to close the estate

Creditor Management

- Publishing notice to creditors in a local newspaper

- Serving known creditors with direct notice

- Advising on the validity of creditor claims

- Objecting to improper claims when necessary

- Managing the 90-day creditor claims period

Asset Administration

- Identifying and inventorying estate assets

- Coordinating property appraisals

- Managing asset distribution to beneficiaries

- Preparing deeds and transfer documents

- Overseeing the sale of estate property when required

Beneficiary Communication

- Notifying beneficiaries of administration

- Providing required accountings to interested parties

- Responding to beneficiary inquiries

- Obtaining waivers and consents when appropriate

Extraordinary Services

Florida Statute §733.6171(4) allows additional compensation for extraordinary services that exceed standard administration requirements:

Litigation and Disputes

- Will contests

- Beneficiary disputes

- Creditor claim litigation

- Breach of fiduciary duty claims

- Removal of personal representative proceedings

Tax Planning and Compliance

- Review and preparation of estate tax returns (Form 706)

- Estate income tax returns (Form 1041)

- Final individual income tax returns (Form 1040)

- Tax planning strategies for the estate and beneficiaries

- IRS audit representation

Complex Asset Handling

- Business valuation and sale

- Real estate in multiple states (ancillary probate)

- Closely held business interests

- Oil, gas, or mineral rights

- Intellectual property

- International assets

- Tax Elections

Special Circumstances

- Estates with significant debts exceeding assets

- Claims against third parties on behalf of the estate

- Construction or interpretation of will provisions

- Homestead determination and distribution

- Active businesses

Figure 3: Comparison of ordinary and extraordinary services under Florida Statute §733.6171

Figure 3: Comparison of ordinary and extraordinary services under Florida Statute §733.6171

How Much Do Probate Attorneys Charge in Florida?

Florida Statute §733.6171 establishes a fee schedule that courts presume to be reasonable for ordinary probate services. This schedule applies unless the attorney and personal representative agree to a different arrangement.

Statutory Fee Schedule for Ordinary Services

Table 2: Florida Statutory Attorney Fee Schedule (2025)

| Estate Value | Presumptively Reasonable Fee |

| $0 to $40,000 | $1,500 |

| $40,001 to $70,000 | $2,250 ($1,500 + $750) |

| $70,001 to $100,000 | $3,000 ($2,250 + $750) |

| $100,001 to $1,000,000 | 3% of value above $100,000 (plus $3,000) |

| $1,000,001 to $3,000,000 | 2.5% of value above $1 million (plus $30,000) |

| $3,000,001 to $5,000,000 | 2% of value above $3 million (plus $80,000) |

| $5,000,001 to $10,000,000 | 1.5% of value above $5 million (plus $120,000) |

| Above $10,000,000 | 1% of value above $10 million (plus $195,000) |

Source: Florida Statute §733.6171(3)

Fee Calculation Examples

Example 1: $500,000 Estate

- Base fee for first $100,000: $3,000

- 3% of $400,000 ($500,000 minus $100,000): $12,000

- Total presumptively reasonable fee: $15,000

Example 2: $2,000,000 Estate

- Base fee for first $1,000,000: $30,000

- 2.5% of $1,000,000 ($2,000,000 minus $1,000,000): $25,000

- Total presumptively reasonable fee: $55,000

Required Attorney Disclosures

Under Florida Statute §733.6171(2)(b), attorneys must provide written disclosures to the personal representative before starting work:

- There is no mandatory statutory attorney fee for estate administration

- The fee is not required to be based on estate size

- The presumed reasonable fee in the statute may not be appropriate in all cases

- The fee is subject to negotiation

- The personal representative is not required to select the attorney who prepared the will

- A summary of services will be provided at the conclusion of representation

Alternative Fee Arrangements

The statutory fee schedule represents a presumption of reasonableness, not a requirement. Many attorneys offer alternative arrangements:

- Flat fees for straightforward estates

- Hourly billing for complex or uncertain situations

- Hybrid arrangements combining flat fees for ordinary services with hourly rates for extraordinary matters

Personal representatives should discuss fee structures with prospective attorneys before engagement. The right arrangement depends on estate complexity, anticipated complications, and the representative’s budget constraints.

How Do Attorneys Help Protect Personal Representatives?

Personal representatives face significant personal liability for mistakes made during estate administration. A probate attorney provides protection through proper guidance and compliance oversight.

Fiduciary Duty Protection

Personal representatives owe fiduciary duties to:

- Estate beneficiaries

- Estate creditors (to a limited extent)

- The probate court

Breaching these duties exposes representatives to personal liability. Common breaches include:

- Failing to collect or preserve estate assets

- Making improper distributions before creditor claims are resolved

- Self-dealing or conflicts of interest

- Missing tax filing deadlines

- Failing to provide required notices and accountings

An attorney ensures the personal representative understands and fulfills these obligations.

Deadline Management

Florida probate involves numerous strict deadlines:

- 10 days to deposit the will with the court after learning of death

- Notice to creditors published promptly after appointment

- 90 days for creditors to file claims after publication

- 60 days to file inventory after letters of administration issue

- Annual accountings required for estates open longer than one year

- Tax return deadlines (Form 1040, Form 1041, Form 706)

Missing these deadlines creates complications ranging from delayed administration to personal liability for resulting damages.

Creditor Claim Protection

Proper creditor notification protects both the estate and the personal representative. Under Florida Statute §733.702, creditors have limited time to file claims after proper notice:

- 30 days from direct service on known creditors

- 3 months from first publication of notice to creditors

- 2 years absolute bar from date of death

An attorney ensures notices are properly served and published, protecting against late claims and personal liability for the representative.

What Should You Look for When Choosing a Probate Attorney?

Selecting the right probate attorney affects how smoothly the estate administration proceeds. Consider these factors when making your choice.

Experience with Large Estates

Not all probate cases are the same. Large estates involve:

- More complex asset structures

- Higher potential for family disputes

- Greater tax implications

- More sophisticated creditor claims

- Longer administration periods

Ask prospective attorneys about their experience with estates similar in size and complexity to yours.

Geographic Knowledge

Florida probate cases are filed in the county where the decedent lived at death. While any Florida-licensed attorney can represent you, local knowledge provides advantages:

- Familiarity with local court procedures

- Relationships with court staff

- Knowledge of local appraisers and professionals

- Understanding of county-specific requirements

For estates with property in multiple Florida counties, choose an attorney comfortable working across jurisdictions.

Communication Style

Estate administration requires ongoing communication between the attorney and personal representative. Look for an attorney who:

- Explains legal concepts in plain language

- Responds to questions promptly

- Keeps you informed of case progress

- Provides clear fee estimates and billing

- Involves you in decisions while offering professional guidance

Fee Structure Transparency

Before engaging an attorney, understand:

- Whether fees follow the statutory schedule or alternative arrangements

- What services the quoted fee covers

- How extraordinary services will be billed

- When payment is expected

- How costs (filing fees, publication costs, appraisals) are handled

Get the fee arrangement in writing before the attorney begins work.

Figure 4: Checklist for selecting the right probate attorney for your estate

Figure 4: Checklist for selecting the right probate attorney for your estate

How Do Attorneys Work with Other Professionals During Probate?

Large estate administration typically requires a team of professionals working together. The probate attorney coordinates this team to ensure efficient, compliant administration.

Certified Public Accountants

CPAs assist with:

- Preparing the decedent’s final income tax return

- Filing estate income tax returns (Form 1041)

- Preparing federal estate tax returns (Form 706) when required

- Advising on tax-efficient distribution strategies

- Providing valuation support for complex assets

The attorney and CPA must communicate closely about deadlines, information sharing, and strategy coordination.

Appraisers

Professional appraisers value:

- Real estate

- Business interests

- Artwork and collectibles

- Jewelry and personal property

- Vehicles and boats

Accurate valuations protect the personal representative, satisfy court requirements, and support tax filings.

Financial Advisors

For estates with investment portfolios, financial advisors help:

- Manage estate investments during administration

- Advise on distribution timing

- Coordinate beneficiary account transfers

- Address inherited IRA and retirement account issues

Real Estate Professionals

When real estate must be sold, real estate agents and title companies:

- Market and sell estate property

- Clear title issues

- Coordinate closings

- Transfer ownership to buyers or beneficiaries

The attorney reviews all real estate transactions to ensure compliance with probate requirements and court orders.

Table 3: Professional Team Roles in Large Estate Administration

| Professional | Primary Responsibilities | When Needed |

| Probate Attorney | Court filings, legal compliance, creditor management, beneficiary distributions | Every formal administration |

| CPA/Tax Advisor | Tax return preparation, tax planning, financial analysis | Most estates, mandatory for large estates |

| Appraiser | Asset valuation for inventory, tax, and distribution purposes | When assets require professional valuation |

| Financial Advisor | Investment management, retirement account coordination | Estates with significant investments |

| Real Estate Agent | Property marketing and sale | When real estate must be sold |

What Role Do Attorneys Play in Probate Disputes?

Family conflicts arise frequently in large estate administration. When disputes occur, the probate attorney’s role shifts from administrative support to dispute resolution or litigation.

Common Dispute Types

Will Contests Challenges to a will’s validity based on:

- Lack of testamentary capacity

- Undue influence by a beneficiary

- Fraud or forgery

- Failure to meet execution requirements

Beneficiary Disputes Disagreements among heirs regarding:

- Interpretation of will provisions

- Valuation of distributed assets

- Timing of distributions

- Treatment of specific property

Fiduciary Misconduct Claims Allegations against the personal representative for:

- Self-dealing

- Mismanagement of assets

- Failure to account properly

- Breach of fiduciary duty

Creditor Claim Disputes Conflicts over:

- Validity of creditor claims

- Amount owed

- Priority of payment

- Asset exemptions

Attorney Roles in Disputes

Depending on the situation, the probate attorney:

Mediates Early Conflicts For minor disagreements, the attorney facilitates communication among parties to reach resolution without formal litigation.

Defends the Personal Representative When claims are made against the estate or representative, the attorney provides defense and legal representation.

Pursues Claims on Behalf of the Estate If third parties owe money to the estate or have wrongfully taken estate property, the attorney pursues recovery.

Represents Beneficiaries Separate counsel may represent beneficiaries with interests adverse to the estate or other parties.

Note: When the personal representative’s interests conflict with beneficiary interests, separate attorneys are required for each party. The estate’s attorney represents the personal representative in their fiduciary capacity, not individual beneficiaries.

What Questions Should You Ask a Probate Attorney?

Before hiring a probate attorney, prepare questions to assess their fit for your situation.

Questions About Experience

- How many large estate administrations have you handled?

- What is the largest estate you have administered?

- Do you have experience with [specific issues in your estate]?

- What percentage of your practice involves probate law?

Questions About Process

- How long do you expect this administration to take?

- What information do you need from me to get started?

- How often will you provide updates on case progress?

- Who in your office will handle day-to-day matters?

Questions About Fees

- How do you calculate your fees for this estate?

- What is your estimate of total fees for ordinary services?

- How are extraordinary services billed?

- When is payment expected?

- How are costs (filing fees, publication, appraisals) handled?

Questions About Communication

- What is the best way to reach you with questions?

- How quickly do you typically respond to client communications?

- Will I receive copies of all documents filed with the court?

- How will you keep me informed of deadlines and required actions?

Frequently Asked Questions

1. Is a probate attorney required for all estates in Florida?

Florida Probate Rule 5.030 requires attorney representation for formal administration when the personal representative is not the sole interested person. For summary administration, attorney representation is recommended but not mandatory. Estates not exceeding $75,000 in non-exempt assets may qualify for summary administration with less stringent requirements.

2. How much do probate attorneys charge in Florida?

Florida Statute §733.6171 establishes a presumptively reasonable fee schedule based on estate value. For estates over $100,000, the fee is 3% of value up to $1 million, with decreasing percentages for larger estates. Attorneys and personal representatives are free to negotiate alternative fee arrangements, including flat fees or hourly billing.

3. Who pays the probate attorney fees in Florida?

Under Florida Statute §733.6171(1), attorney fees are paid from estate assets without requiring a court order. The personal representative does not pay attorney fees from personal funds. Fees are a cost of administration paid before distributions to beneficiaries.

4. What does a probate attorney do for the personal representative?

The probate attorney prepares and files court documents, manages creditor claims, advises on asset distribution, ensures tax compliance, and guides the personal representative through legal requirements. The attorney also represents the personal representative in court proceedings and helps avoid errors that create personal liability.

5. Can I be my own attorney in Florida probate?

Only attorneys admitted to practice in Florida can represent personal representatives in probate proceedings. A personal representative who is a Florida-licensed attorney can represent themselves. Non-attorney personal representatives must hire counsel unless they are the sole interested person in the estate.

6. How long does probate take with an attorney in Florida?

Formal administration typically takes 10 to 12 months for straightforward estates. Complex estates with disputes, tax issues, or multi-state property require longer. Summary administration concludes in 1 to 3 months. The attorney’s experience and efficiency affect timeline, as does cooperation from beneficiaries and third parties.

7. What is the difference between a probate attorney and an estate planning attorney?

Estate planning attorneys help clients create wills, trusts, and other documents before death. Probate attorneys handle estate administration after death. Many attorneys practice both areas. For large estates, working with an attorney experienced in probate administration ensures familiarity with court procedures and administration requirements.

8. Can family members dispute attorney fees in Florida probate?

Yes. Under Florida law, any interested person can object to attorney fees. If objections are raised, the court determines whether fees are reasonable based on factors including time spent, complexity, results obtained, and customary fees in the area. The attorney must provide documentation supporting the fee request.

9. What happens if the personal representative and attorney disagree?

The personal representative has discretion to select their own attorney. If disagreements arise during administration, the personal representative can seek new counsel with court approval. The withdrawing attorney is entitled to reasonable fees for services provided up to that point.

10. Do I need a probate attorney if there is no will?

Yes. When someone dies without a will (intestate), Florida law determines who inherits through intestate succession rules. The probate process still requires court supervision and attorney representation for estates requiring formal administration. An attorney ensures proper identification of heirs and compliant distribution under intestate succession laws.

Action Steps for Personal Representatives

If you have been named personal representative of a large Florida estate, take these steps:

- Gather essential documents including the original will, death certificates, and financial account statements

- Contact a probate attorney experienced with estates similar in size and complexity to yours

- Understand the fee arrangement before the attorney begins work

- Compile an asset inventory to help your attorney assess estate value and administration requirements

- Identify potential complications including family disputes, creditor claims, or tax issues

- Plan for the time commitment required for your role as personal representative

- Communicate regularly with your attorney throughout the process

Working with a qualified probate attorney protects both you and the estate beneficiaries while ensuring efficient, compliant administration.

Protecting Your Family Is a Phone Call Away

Serving as personal representative for a large estate involves significant responsibility. The attorneys at SJF Law Group provide comprehensive guidance through every phase of probate administration. From initial court filings through final distributions, our team ensures legal compliance while protecting your interests as fiduciary.

We handle large estate probate services throughout Florida, bringing years of experience to complex estate matters. When you work with SJF Law Group, you receive clear communication, transparent fee arrangements, and dedicated support throughout the administration process.

Call us at 954-580-3690 or email info@estateandprobatelawyer.com today to schedule a consultation.