Key Takeaways

Selecting the right executor for a large Florida estate requires careful consideration of legal requirements, personal qualities, and practical factors. Here are the essential points:

- Florida calls executors “personal representatives.” The terms are interchangeable, but Florida law uses “personal representative” in all statutes and court documents.

- Non-residents face strict eligibility rules. Under Florida Statute §733.304, out-of-state residents must be related to the decedent by blood, adoption, or marriage to serve.

- Felony convictions disqualify candidates. Florida prohibits anyone with a felony conviction or conviction for elder abuse from serving as personal representative.

- Estates over $75,000 require formal administration. This triggers court oversight, strict deadlines, and mandatory attorney representation under Florida Statute §735.201.

- Executors earn statutory compensation. Florida law allows 3% for the first $1 million, decreasing to 1.5% for amounts over $10 million under Florida Statute §733.617.

- Professional fiduciaries handle complex estates. Banks, trust companies, and attorneys authorized in Florida serve as alternatives when family members are unavailable or unsuitable.

- Surety bonds protect beneficiaries. Unless waived in the will or by the court, personal representatives must purchase a bond under Florida Statute §733.402.

- The wrong choice creates delays and litigation. Poor executor selection turns a 12-month process into years of court battles, depleting estate assets.

Introduction

Choosing an executor for a large Florida estate ranks among the most consequential decisions in estate planning. This person, known legally as the personal representative in Florida, controls your family’s financial future after your death.

For estates valued over $75,000, the stakes are higher. Florida requires formal administration with court supervision, detailed accountings, and strict compliance with probate deadlines. The personal representative must manage creditors, communicate with beneficiaries, file tax returns, and distribute assets according to your will.

Personal representatives for large probate estates in Florida face questions like:

- Who qualifies to serve under Florida law?

- What happens if my first choice lives out of state?

- Should I name a family member or professional fiduciary?

- What are the risks of choosing the wrong person?

This guide breaks down Florida’s executor requirements, compensation rules, and practical strategies for selecting someone who will protect your legacy and minimize family conflict.

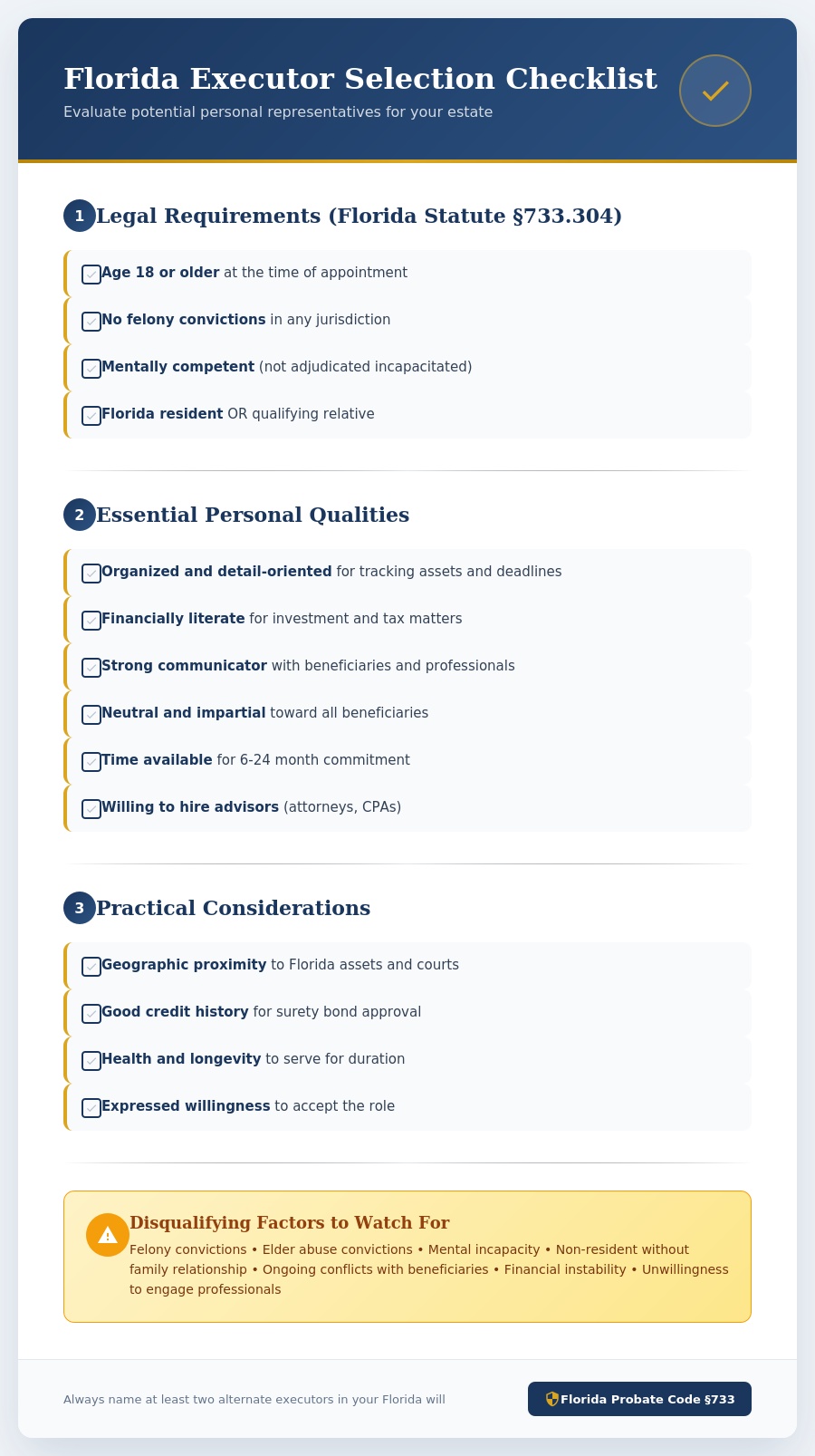

What Does Florida Law Require for a Personal Representative?

Florida imposes specific eligibility requirements on anyone who serves as personal representative. These rules exist under Florida Probate Code Chapter 733 and apply to all formal probate administrations.

Basic Eligibility Requirements

| Requirement | Details |

|---|---|

| Age | Must be at least 18 years old |

| Mental capacity | Must be legally competent (not adjudicated incapacitated) |

| Criminal history | No felony convictions |

| Elder abuse | No convictions for abuse, neglect, or exploitation of elderly or disabled adults |

| Residency | Florida resident OR qualified non-resident relative |

Figure 1: Basic Eligibility Requirements for Florida Personal Representatives Source: Florida Statutes §733.303, §733.304

Who Is Disqualified From Serving?

Florida law prohibits several categories of individuals from serving:

- Anyone under 18 years old

- Individuals adjudicated mentally incapacitated by a court

- Convicted felons (any felony, in any jurisdiction)

- Anyone convicted of abuse, neglect, or exploitation of an elderly person or disabled adult

- Non-residents who do not meet relationship requirements

The Florida Bar’s Consumer Pamphlet on Probate explains that these restrictions protect estate assets and beneficiaries from potential mismanagement.

Can a Non-Resident Serve as Personal Representative in Florida?

This question comes up constantly for Florida families with relatives spread across the country. The answer depends entirely on the relationship between the proposed executor and the decedent.

Florida’s Non-Resident Rules

Under Florida Statute §733.304, a non-resident of Florida qualifies to serve as personal representative ONLY if they are:

- A legally adopted child or adoptive parent of the decedent

- Related to the decedent by lineal consanguinity (parent, child, grandparent, grandchild)

- A spouse, brother, sister, uncle, aunt, nephew, or niece of the decedent

- Someone related by lineal consanguinity to any person in the category above

- The spouse of a person who qualifies under any of these categories

Who Does NOT Qualify as an Out-of-State Executor?

The following individuals CANNOT serve as personal representative if they live outside Florida:

- Close friends (regardless of how trusted)

- Business partners

- Attorneys who are not relatives

- Professional fiduciaries located in other states

- Second cousins or more distant relatives

According to Miami probate attorneys, naming a non-qualifying out-of-state person is one of the most common drafting mistakes in Florida wills.

Practical Challenges for Out-of-State Executors

Even when an out-of-state relative qualifies to serve, practical problems arise:

| Challenge | Impact |

|---|---|

| Travel requirements | Multiple trips to Florida for court appearances, asset management |

| Local knowledge gaps | Unfamiliarity with Florida probate procedures and deadlines |

| Bonding requirements | Out-of-state executors often face mandatory bond requirements |

| Time zone differences | Difficulty coordinating with Florida attorneys, courts, and institutions |

| Additional expenses | Travel, lodging, and local professional fees reduce estate value |

Figure 2: Challenges Facing Out-of-State Personal Representatives

What Qualities Make the Best Executor for a Large Estate?

Meeting Florida’s legal requirements is the minimum threshold. Large estates demand personal representatives with specific skills and temperament.

Essential Qualities for Large Estate Executors

Organization and attention to detail. Large estates involve tracking multiple properties, investment accounts, business interests, and creditor claims. The personal representative must maintain meticulous records and meet strict deadlines. Under Florida law, the inventory of assets must be filed with the court within 60 days of appointment.

Financial literacy. Managing a multi-million dollar estate requires understanding of investments, tax obligations, and cash flow management. The executor must work with CPAs on estate tax returns (Form 706) and income tax filings (Form 1041).

Communication skills. The personal representative serves as the primary contact for beneficiaries, creditors, attorneys, and financial institutions. Clear, regular updates prevent misunderstandings that escalate into litigation.

Neutrality and fairness. Large estates with multiple beneficiaries need executors who treat everyone impartially. Family members who also stand to inherit face potential conflicts of interest.

Willingness to hire advisors. Under Florida Probate Rule 5.030, formal administration requires attorney representation. The best executors recognize their limitations and engage qualified professionals.

Time availability. Probate for large estates takes 6 to 12 months minimum. Complex or contested estates extend to several years. The personal representative must dedicate significant time throughout this period.

Red Flags to Avoid

The St. Petersburg Estate Planning Attorneys at Fisher & Wilsey identify warning signs when selecting an executor:

- History of financial problems or poor credit (makes obtaining bond difficult)

- Ongoing conflicts with beneficiaries

- Inability to make timely decisions

- Lives far away with limited availability

- Health issues that affect capacity to serve

- Unwillingness to engage professional help

Should I Name a Family Member or Professional Fiduciary?

This decision shapes how your estate administration unfolds. Both options have advantages and drawbacks for large Florida estates.

Family Member Executors

Advantages:

- Personal knowledge of family dynamics and your wishes

- Emotional investment in honoring your legacy

- No additional professional fees for the executor role

- Familiar relationships with other beneficiaries

Disadvantages:

- Lack of probate experience leads to mistakes

- Emotional burden during grief compounds administrative stress

- Potential conflicts with siblings or other beneficiaries

- Time constraints from work and family obligations

Professional Fiduciaries

Florida permits several types of professional fiduciaries to serve as personal representatives under Florida Statute §733.305:

- Trust companies incorporated under Florida law

- State banking corporations authorized for fiduciary activities

- Savings associations authorized in Florida

- National banking associations with Florida fiduciary authority

- Attorneys licensed in Florida

Advantages:

- Expertise in probate procedures and deadlines

- Neutral position reduces family conflicts

- Professional liability insurance and bonding

- Access to legal, tax, and investment resources

- Continuity (individuals retire, move, or become incapacitated)

Disadvantages:

- Professional fees reduce estate assets

- Less personal knowledge of family relationships

- Corporate trustees follow standardized procedures

- Minimum estate value requirements at some institutions

When to Consider a Professional Fiduciary

According to Beacon Legacy Law, professional fiduciaries make sense when:

- No family member qualifies or is willing to serve

- Family conflict makes neutral administration essential

- The estate includes complex assets (businesses, real estate portfolios, international holdings)

- Beneficiaries include minors or individuals with special needs

- Long-term trust administration continues after probate

- The estate exceeds $5 million and requires sophisticated tax planning

How Much Do Personal Representatives Earn in Florida?

Florida law provides statutory compensation for personal representatives based on the estate’s value. This compensation acknowledges the significant time and responsibility involved.

Standard Compensation Schedule

Florida Statute §733.617 establishes presumptively reasonable compensation:

| Estate Value | Compensation Rate |

|---|---|

| First $1 million | 3% |

| $1 million to $5 million | 2.5% |

| $5 million to $10 million | 2% |

| Over $10 million | 1.5% |

Figure 3: Florida Personal Representative Compensation Schedule Source: Florida Statute §733.617(2)

Compensation Examples

| Estate Size | Personal Representative Fee |

|---|---|

| $500,000 | $15,000 |

| $1,000,000 | $30,000 |

| $2,500,000 | $67,500 |

| $5,000,000 | $130,000 |

| $10,000,000 | $230,000 |

Figure 4: Sample Executor Fee Calculations for Florida Estates

Important Compensation Details

Compensable value includes:

- Inventory value of probate estate assets

- Income earned by the estate during administration

Compensable value excludes:

- Non-probate assets (life insurance, retirement accounts with beneficiaries, trust assets)

- Protected homestead property

Extraordinary services earn additional fees. Under Florida Statute §733.617(4), personal representatives petition the court for extra compensation when handling:

- Will contests or litigation

- Tax audits and IRS proceedings

- Sales of real property

- Business operations during administration

- Complex asset valuations

Can Executors Waive Fees?

Yes. Personal representatives who are also primary beneficiaries often waive fees to:

- Avoid income tax on compensation (fees are taxable income)

- Preserve more assets for distribution

- Demonstrate good faith to other beneficiaries

What Are Florida’s Bonding Requirements for Executors?

Surety bonds protect beneficiaries and creditors from executor misconduct. Understanding these requirements helps you plan accordingly.

When Is a Bond Required?

Under Florida Statute §733.402, every personal representative must file a surety bond UNLESS:

- The will specifically waives the bond requirement

- The court waives the bond requirement

- The personal representative is a bank or trust company authorized as a Florida fiduciary

How Is the Bond Amount Determined?

Florida Statute §733.403 gives the court discretion to set bond amounts based on:

- Gross value of the estate

- Type and liquidity of assets

- Relationship of personal representative to beneficiaries

- Known creditors and encumbrances

- Whether real estate will be sold

According to BondExchange, the bond amount typically equals the value of personal property plus annual income. Real estate value is added if the personal representative plans to sell.

Bond Costs

| Bond Amount | Approximate Annual Premium |

|---|---|

| $50,000 | $275-$350 |

| $100,000 | $400-$500 |

| $500,000 | $1,500-$2,500 |

| $1,000,000 | $2,500-$4,000 |

Figure 5: Estimated Florida Personal Representative Bond Premiums Note: Actual premiums vary based on credit score and surety company

Bond premiums are allowable estate administration expenses under Florida Statute §733.406.

Waiving Bond Requirements in Your Will

Most estate planning attorneys recommend including bond waiver language in wills when naming trusted family members. This saves the estate money and speeds up the appointment process.

Sample language: “I direct that my Personal Representative serve without bond.”

The court retains discretion to require a bond despite waiver language if beneficiaries petition or circumstances warrant protection.

What Happens If the Executor Fails in Their Duties?

Personal representatives hold fiduciary duties. Breaching these duties creates serious consequences.

Fiduciary Duties Under Florida Law

Florida Statute §733.602 establishes that personal representatives:

- Must observe standards of care applicable to trustees

- Must settle and distribute the estate expeditiously and efficiently

- Must act in the best interests of beneficiaries and creditors

- Must use authority only for proper purposes

Grounds for Removal

Under Florida Statute §733.504, the court removes personal representatives who:

- Have been adjudicated incapacitated

- Fail to perform their duties

- Mismanage estate assets

- Commit breach of fiduciary duty

- Have conflicts of interest affecting administration

- Are no longer qualified (felony conviction, moves out of state)

Consequences of Breach

According to Florida probate litigation attorneys, breaching fiduciary duties results in:

- Removal from position

- Personal liability for losses caused to the estate

- Restitution to beneficiaries

- Denial of compensation

- Attorney’s fees awards to prevailing parties

How Do I Name Alternate Executors?

Every Florida will should name backup personal representatives. Life circumstances change, and your first choice may be unable or unwilling to serve when the time comes.

Why Alternates Matter

Your primary executor might:

- Predecease you

- Become incapacitated

- Move out of state (disqualifying non-relatives)

- Decline to serve due to health, time constraints, or personal reasons

- Be disqualified by subsequent felony conviction

Without an alternate, the court appoints someone under Florida Statute §733.301, following statutory priority:

- Surviving spouse

- Person selected by majority of beneficiaries

- Nearest heir

Best Practices for Naming Alternates

Name at least two alternates. This provides backup if both your primary and first alternate become unavailable.

Include someone younger. For married couples naming each other as primary, include an adult child or younger sibling as alternate.

Verify residency status. Out-of-state alternates must qualify under Florida Statute §733.304.

Consider professional backup. Name a trust company or attorney as final alternate for large estates.

Should I Name Co-Executors for a Large Estate?

Co-executors share responsibilities and provide checks and balances. This arrangement works well in some situations but creates complications in others.

When Co-Executors Make Sense

- Blended families where each side deserves representation

- Estates requiring different expertise (one executor handles business, another handles investments)

- Geographic distribution (one local, one out-of-state relative)

- Building experience for eventual successor

Potential Problems With Co-Executors

Decision-making delays. Florida requires co-executors to act together on most matters. Disagreements stall administration.

Communication failures. Beneficiaries receive conflicting information from different executors.

Compensation disputes. Multiple executors share fees, creating potential conflicts about work distribution.

Florida’s Rules for Multiple Personal Representatives

Florida Statute §733.617(5) addresses compensation when multiple personal representatives serve:

- For estates $100,000 or more: One full commission goes to the executor with primary responsibility; one full commission splits among remaining executors

- For estates under $100,000: One full commission splits among all executors

What Steps Should You Take to Select the Right Executor?

Follow this process to identify and prepare your personal representative.

Step 1: Assess Your Estate Complexity

Consider what your executor will manage:

- Number and type of properties

- Business interests requiring ongoing operations

- Investment portfolio complexity

- Number of beneficiaries and their relationships

- Likelihood of family disputes

- Tax obligations (Form 706 filing threshold)

Step 2: Identify Candidates

Create a list of potential executors who:

- Meet Florida legal requirements

- Possess necessary skills and temperament

- Have time availability

- Are willing to serve

Step 3: Have Direct Conversations

Before naming someone in your will:

- Explain the responsibilities involved

- Discuss compensation expectations

- Confirm willingness to serve

- Provide overview of estate assets and family dynamics

Step 4: Document Your Choice

Work with a Florida probate attorney to:

- Draft will language naming primary and alternate executors

- Include bond waiver if appropriate

- Specify any special instructions or limitations

- Execute documents with proper witnesses and notarization

Step 5: Prepare Your Executor

Help your chosen personal representative by:

- Creating a location list for important documents

- Introducing them to your attorney and financial advisor

- Providing contact information for beneficiaries

- Updating this information regularly

Caption: Use this checklist to evaluate potential personal representatives for your Florida estate.

Caption: Use this checklist to evaluate potential personal representatives for your Florida estate.

Frequently Asked Questions

1. What is the difference between an executor and a personal representative in Florida?

There is no difference. Florida law uses the term “personal representative” instead of “executor” or “administrator.” The roles and responsibilities are identical. If your will names an “executor,” that person serves as the personal representative under Florida Probate Code Chapter 733.

2. Can my adult child who lives in another state serve as executor of my Florida estate?

Yes. Under Florida Statute §733.304, children of the decedent qualify to serve as personal representative regardless of where they live. This includes biological children, adopted children, and stepchildren. The out-of-state executor may face bonding requirements and additional logistical challenges.

3. How long does it take to settle a large estate in Florida?

Standard probate for estates over $75,000 takes 6 to 12 months. Complex estates with real property sales, business interests, tax issues, or beneficiary disputes extend to 2 to 5 years. IRS involvement for Form 706 (federal estate tax return) adds 9 to 15 months to the timeline.

4. Can I name my attorney as executor in Florida?

Yes, attorneys qualify as personal representatives in Florida. Florida Statute §733.617(9) requires specific disclosure when an attorney is named in the will. The attorney must provide written disclosure that the nomination was not a condition of the attorney preparing the will, and the client must sign an acknowledgment.

5. What happens if the person I named as executor cannot serve?

The court looks to alternates named in your will. If no qualified alternate exists, the court appoints a personal representative under Florida Statute §733.301, giving preference to surviving spouses, then beneficiaries or heirs selected by majority interest.

6. Are executor fees taxable income?

Yes. Personal representative compensation is taxable income to the person receiving it. The estate deducts the fees as an administrative expense. Executors who are also beneficiaries sometimes waive fees to avoid this tax consequence.

7. Can a beneficiary of the estate also serve as executor in Florida?

Yes. Florida does not prohibit beneficiaries from serving as personal representatives. This is common when a surviving spouse or adult child inherits and also manages the estate. The executor still owes fiduciary duties to all beneficiaries and must act impartially.

8. How do I remove an executor who is not doing their job?

Beneficiaries and interested parties petition the court for removal under Florida Statute §733.504. Grounds include failure to perform duties, mismanagement, breach of fiduciary duty, and conflict of interest. The court evaluates whether removal serves the estate’s best interests.

9. Do I need a Florida resident to serve as executor?

Not necessarily. Florida residents qualify automatically if they meet other requirements. Non-residents qualify only if related to the decedent by blood, adoption, or marriage under Florida Statute §733.304. Unrelated non-residents (friends, business associates, out-of-state attorneys) cannot serve.

10. Can a bank or trust company serve as executor in Florida?

Yes. Florida Statute §733.305 authorizes banks, trust companies, and savings associations to serve as personal representatives if they are authorized to exercise fiduciary powers in Florida. Corporate fiduciaries do not require bond and provide continuity for long-term administration.

Protecting Your Family Is a Phone Call Away

Selecting the right executor protects your family’s inheritance and prevents costly disputes. A single conversation with an experienced probate attorney clarifies your options and ensures your wishes are properly documented.

The estate planning attorneys at SJF Law Group guide families through large estate probate services and executor selection. When you work with our team, you receive clear guidance on Florida’s requirements and practical strategies for your unique situation.

Call us at 954-580-3690 or email info@estateandprobatelawyer.com today.