Key Takeaways

Understanding taxes in Florida probate helps personal representatives avoid costly mistakes and personal liability. Here are the essential points:

- Florida has no state estate tax or inheritance tax. The Florida Constitution prohibits these taxes, making the state attractive for high-net-worth individuals.

- Federal estate tax applies to estates exceeding $15 million per person (effective January 1, 2026). Married couples benefit from a $30 million combined exemption under the One Big Beautiful Bill Act.

- Three separate tax returns require attention. The decedent’s final Form 1040, estate income tax return (Form 1041), and federal estate tax return (Form 706) if applicable.

- Form 706 must be filed within 9 months of death for estates above the exemption threshold, with a 6-month extension available.

- Step-up in basis saves heirs significant capital gains taxes. Certain inherited assets receive a new tax basis equal to fair market value at the date of death.

- Estate income over $600 triggers Form 1041 filing. Rental income, dividends, and interest earned after death require a separate estate income tax return.

- Portability elections preserve unused exemption amounts. Surviving spouses must file Form 706 to claim the deceased spouse’s unused exemption.

- Professional guidance prevents errors. A probate attorney and CPA working together reduce audit risk and missed deductions.

Introduction

Managing a large probate estate in Florida involves more than distributing assets to heirs. Tax obligations require careful attention to deadlines, accurate valuations, and proper filings with both federal and state agencies.

For estates valued over $75,000, Florida requires formal administration under Florida Statute §735.201. While Florida offers a favorable tax environment with no state estate or inheritance tax, federal tax requirements still apply to many large estates.

Personal representatives face questions like:

- What tax returns need to be filed?

- When are the deadlines?

- How do capital gains taxes affect inherited property?

- What happens if the estate exceeds the federal exemption?

This guide breaks down the tax implications for large probate estates in Florida and provides practical steps to minimize tax burdens while staying compliant.

Does Florida Have a State Estate Tax or Inheritance Tax?

No. Florida does not impose a state estate tax or inheritance tax on residents or their heirs.

The Florida Constitution prohibits inheritance taxes. This constitutional protection means the Florida legislature cannot enact a state estate tax without 60% voter approval to amend the constitution (Alper Law, 2025).

Florida eliminated its estate tax in 2005 after the federal “pick-up” credit was repealed. According to the Florida Department of Revenue, no Florida estate tax is due for decedents who died on or after January 1, 2005.

This tax-friendly environment makes Florida attractive for wealthy individuals. Many relocate from northeastern states with significant state inheritance taxes to reduce their overall tax burden.

Important: While Florida has no state estate tax, Florida residents who inherit property from states like Iowa, Kentucky, Maryland, Nebraska, New Jersey, or Pennsylvania may owe inheritance tax to those states.

What is the Federal Estate Tax Exemption for 2025 and 2026?

The federal estate tax exemption changed significantly with the passage of the One Big Beautiful Bill Act (OBBBA) on July 4, 2025.

| Year | Federal Estate Tax Exemption (Individual) | Married Couple (Combined) |

| 2025 | $13.99 million | $27.98 million |

| 2026 and beyond | $15 million | $30 million |

Source: IRS Form 706 Instructions (September 2025); Pierce Atwood Analysis

The OBBBA made the increased exemption permanent with no sunset clause. Starting in 2027, the $15 million amount will be indexed for inflation (Morgan Lewis, August 2025).

For estates exceeding the exemption amount, the federal estate tax imposes a graduated rate of 40% on the excess.

What Does This Mean for Florida Families?

For an unmarried Florida resident with a net worth below $15 million, or a married couple below $30 million, it’s not likely any federal estate taxes will be owed.

Florida’s lack of a state estate tax amplifies this benefit. Residents of states like New York still face state estate taxes with much lower exemptions. Floridians take full advantage of federal increases without state-level complications (Palm City Lawyer, 2025).

What Tax Returns Must Be Filed for a Florida Probate Estate?

Under Florida Statute §733.602, the personal representative acts as fiduciary for the estate. This responsibility includes filing all required tax returns.

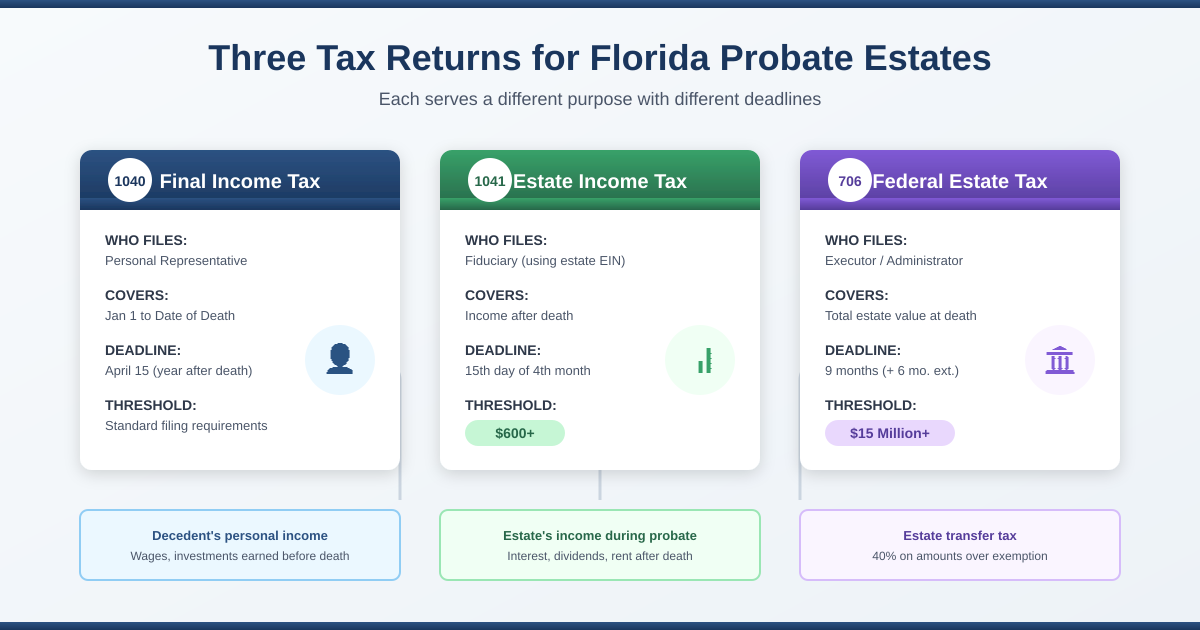

Three types of tax filings may apply:

| Tax Return | Purpose | Filing Threshold | Deadline |

| Form 1040 | Decedent’s final income tax return | Standard income filing requirements | April 15 of year following death |

| Form 1041 | Estate income tax return | Gross income over $600 | April 15 or 15th day of 4th month after fiscal year ends |

| Form 706 | Federal estate tax return | Gross estate exceeds exemption ($13.99M in 2025, $15M in 2026) | 9 months after death (6-month extension available) |

Figure 1: Tax Filing Requirements for Florida Probate Estates

Source: IRS.gov

What is the Decedent’s Final Income Tax Return (Form 1040)?

This covers income earned from January 1 until the date of death. The personal representative must:

- File Form 1040 on behalf of the decedent under 26 U.S.C. § 6012(b)(1)

- Pay outstanding income taxes from estate assets

- Meet the standard April 15 deadline of the year following death

- Write “Deceased,” the decedent’s name, and date of death at the top of the form

If the decedent had unfiled returns from prior years, the estate must file those as well. The IRS reviews final returns carefully, knowing this represents their last opportunity to collect (Florida Probate Firm).

What Triggers an Estate Income Tax Return (Form 1041)?

If the estate generates more than $600 of gross income after death, a Form 1041 filing becomes required. This income might include:

- Interest on bank accounts

- Dividends from investments

- Rental income from properties

- Capital gains from asset sales

Filing Form 1041 requires obtaining an Employer Identification Number (EIN) from the IRS. The estate uses this EIN instead of the decedent’s Social Security number (Legacy Protection Lawyers).

The fiduciary (personal representative) reports income, deductions, gains, and losses on Form 1041. If distributions are made to beneficiaries, they receive Schedule K-1 forms showing amounts to include on their personal returns (IRS Instructions for Form 1041).

When is Form 706 Required for a Florida Estate?

Form 706 must be filed for the estate of every U.S. citizen or resident whose gross estate, plus adjusted taxable gifts and specific gift tax exemption, exceeds the filing threshold.

For decedents dying in 2025, this threshold is $13.99 million. For 2026 and beyond, the threshold increases to $15 million (IRS Form 706 Instructions, September 2025).

What Assets Are Included in the Gross Estate?

The gross estate includes everything the decedent owned or had certain interests in at death:

- Cash and bank accounts

- Securities and investment accounts

- Real estate (including out-of-state property)

- Life insurance proceeds (if the decedent owned the policy)

- Retirement accounts (IRAs, 401(k)s)

- Business interests

- Personal property (vehicles, jewelry, collectibles)

- Jointly owned property (decedent’s share)

- Trust assets (depending on trust structure)

Both probate and non-probate assets count toward the gross estate for tax purposes (IRS FAQ on Estate Taxes).

What Are the Form 706 Deadlines?

| Deadline Type | Timeframe | Form Required |

| Initial Filing Deadline | 9 months after date of death | Form 706 |

| Extension Request | Before initial deadline | Form 4768 |

| Extended Deadline | 15 months after death | Form 706 |

| Portability Election (estates below threshold) | Up to 5 years after death | Form 706 (simplified) |

Source: Spencer Fane (October 2025)

Note: The extension to file does not extend the time to pay taxes. Estates owing tax must remit payment by the original 9-month deadline or face interest and penalties.

What is the Portability Election and Why Does It Matter?

Portability allows a surviving spouse to use the deceased spouse’s unused federal estate tax exemption. This provision, called the Deceased Spousal Unused Exclusion (DSUE), effectively doubles the exemption available to married couples.

For 2026 and beyond, portability means a surviving spouse could have up to $30 million in exemption if the first spouse used none of their $15 million exemption.

How Do You Elect Portability?

To elect portability, the surviving spouse (or their representative) must:

- File Form 706 for the deceased spouse’s estate

- File the return timely (within the 9-month deadline or extended 15-month deadline)

- Complete Sections B and C of Part VI on Form 706

Estates below the filing threshold have special relief under Revenue Procedure 2022-32. These estates can file up to five years after death to make the portability election, provided the return is complete and properly prepared (Spencer Fane).

What Happens If You Miss the Portability Deadline?

Missing the portability election deadline means losing millions of dollars in potential tax exemptions. A surviving spouse who could have inherited their deceased spouse’s unused exemption would be limited to their own exemption amount.

This mistake becomes costly if the surviving spouse’s estate later exceeds the single-person exemption threshold.

How Does Step-Up in Basis Reduce Capital Gains Taxes?

Step-up in basis provides one of the most significant tax benefits for heirs. Under Internal Revenue Code Section 1014, certain inherited assets receive a new tax basis equal to their fair market value at the date of death.

How Does Step-Up in Basis Work?

When you inherit an asset, the IRS “steps up” the cost basis from what the decedent originally paid to the current market value. This adjustment eliminates capital gains taxes on appreciation during the decedent’s lifetime.

Example:

| Scenario | Original Purchase Price | Value at Death | Sale Price | Taxable Gain |

| Without Step-Up | $100,000 | $500,000 | $550,000 | $450,000 |

| With Step-Up | $500,000 (adjusted) | $500,000 | $550,000 | $50,000 |

Source: Fidelity (May 2025)

In this example, step-up in basis reduces the taxable gain from $450,000 to $50,000, potentially saving the heir over $90,000 in capital gains taxes at the 20% long-term rate.

What Assets Qualify for Step-Up in Basis?

Assets commonly receiving step-up treatment include:

- Real estate (homes, rental properties, land)

- Stocks and mutual funds in taxable accounts

- Business interests

- Artwork and collectibles

- Vehicles

What Assets Do NOT Qualify for Step-Up?

Certain assets follow different rules:

- IRAs and 401(k)s: Follow income tax rules, not capital gains rules. Distributions are taxed as ordinary income.

- Gifted property: Retains the donor’s original basis (carryover basis)

- Property gifted and returned: If you gift property and inherit it back within one year, no step-up applies

How Does Step-Up Work in Community Property States?

While Florida is not a community property state, the distinction matters for couples who moved from community property states like California or Texas.

In community property states, both halves of community property receive a step-up when one spouse dies. In Florida and other common law states, only the decedent’s share receives a step-up. This difference affects couples with highly appreciated assets acquired in community property states (Geiger Law Office).

What Deductions Reduce Estate and Income Tax Liability?

Strategic use of deductions reduces both estate taxes (Form 706) and income taxes (Form 1041). Understanding where to claim deductions creates tax planning opportunities.

Common Estate Tax Deductions (Form 706)

- Marital deduction: Unlimited deduction for assets passing to a surviving spouse

- Charitable deduction: Full deduction for assets passing to qualified charities

- Administrative expenses: Legal fees, accounting fees, executor compensation

- Debts and mortgages: Outstanding liabilities at death

- Funeral expenses: Reasonable funeral and burial costs

- State death taxes: Deduction for estate taxes paid to other states

Common Income Tax Deductions (Form 1041)

- Administration expenses: Court filing fees, publication costs, bond premiums

- Professional fees: Attorney, accountant, and tax preparer fees

- Income distribution deduction: Income passed through to beneficiaries

- Losses: Capital losses and casualty losses

Tax Planning Tip: Elective deductions (like administrative expenses) cannot be claimed on both Form 706 and Form 1041. Work with tax professionals to determine which return provides greater benefit. For estates below the federal exemption, Form 1041 deductions typically provide better savings (Wiggin and Dana, September 2025).

How Do Property Taxes Affect Florida Probate Estates?

While not directly part of estate taxation, property taxes represent ongoing costs during probate administration. Florida’s effective property tax rate increased to 0.76% in 2024 (Florida Probate and Family Law Firm, 2025).

Personal representatives must continue paying property taxes on estate real estate until distribution or sale. For a $1 million property, annual property taxes could exceed $7,600.

Florida Homestead Considerations

Florida’s homestead exemption provides unique benefits:

- Property tax exemption up to $50,000 for primary residence

- Creditor protection under Florida Constitution Article X, Section 4

- Special transfer rules for surviving spouses and children

What Are Common Tax Mistakes in Florida Probate?

Personal representatives without proper guidance often make costly errors. These mistakes lead to penalties, audits, and personal liability.

Top Tax Mistakes to Avoid

| Mistake | Consequence | Prevention |

| Missing Form 706 deadline | Loss of portability election, penalties up to 25% of tax due | Calendar all deadlines immediately after death |

| Failing to obtain EIN | Inability to open estate accounts or file Form 1041 | Apply for EIN within first week |

| Distributing assets before taxes paid | Personal liability for unpaid taxes | Wait for tax clearance before final distributions |

| Incorrect asset valuations | IRS audit, additional taxes, penalties | Hire qualified appraisers for real estate and business interests |

| Missing income from decedent’s final year | Underreported income, penalties | Gather all 1099s and W-2s before filing |

| Claiming deductions on wrong return | Lost tax benefits or duplicate deduction penalties | Coordinate with CPA on Form 706 vs. Form 1041 elections |

Figure 2: Common Tax Mistakes in Florida Probate

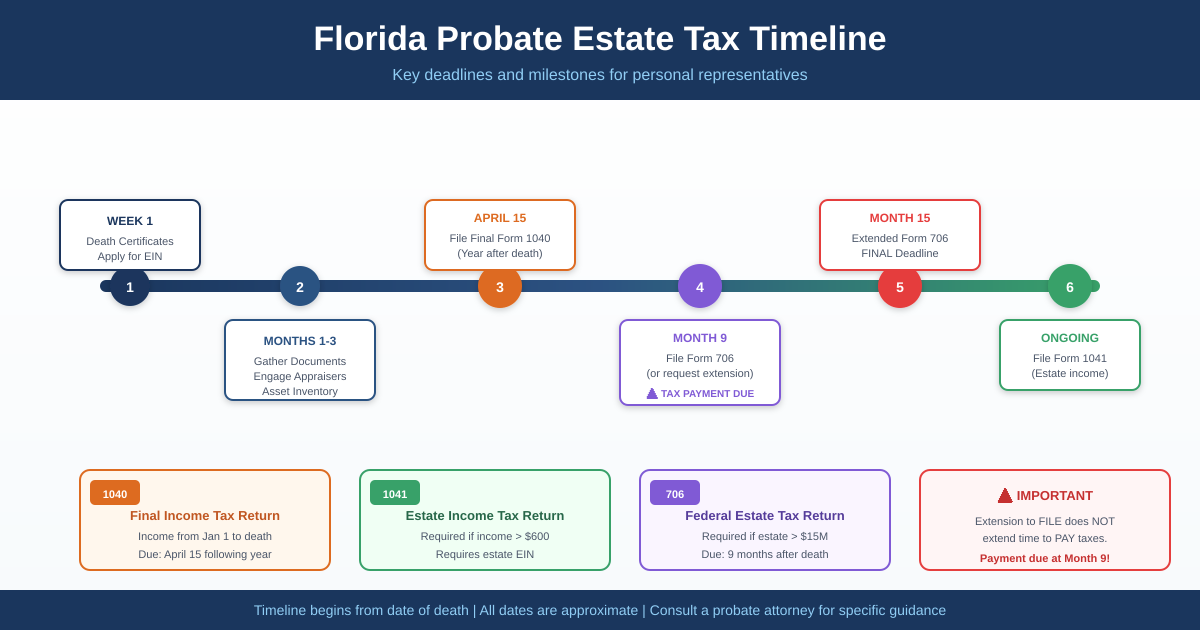

What is the Tax Timeline for a Large Florida Estate?

Understanding the tax timeline helps personal representatives stay organized and avoid penalties.

| Timeframe | Action Required |

| Week 1 | Obtain certified death certificates (order 10+ copies) |

| Week 2 | Apply for EIN from IRS |

| Month 1 | Gather asset valuations, engage appraisers |

| Month 3 | Complete asset inventory with values as of date of death |

| April 15 (year after death) | File decedent’s final Form 1040 |

| Month 9 | File Form 706 (or request extension with Form 4768) |

| Month 15 | Final deadline for Form 706 with extension |

| Fiscal year end + 3.5 months | File Form 1041 for estate income |

Figure 3: Tax Filing Timeline for Large Florida Probate Estates

Source: IRS.gov

How Do Trusts Affect Estate Taxation in Florida?

Trusts play a significant role in estate tax planning. Different trust types have different tax implications.

Revocable Living Trusts

Assets in a revocable trust are included in the gross estate for tax purposes. These trusts provide probate avoidance but not estate tax avoidance. Heirs still receive step-up in basis on trust assets (District Capital Management, 2025).

Irrevocable Trusts

Properly structured irrevocable trusts remove assets from the taxable estate. The One Big Beautiful Bill Act makes irrevocable trusts more attractive for families with significant wealth above the $15 million/$30 million thresholds.

Dynasty Trusts

Florida’s trust laws allow dynasty trusts that last for multiple generations. With the increased GST exemption matching the estate tax exemption at $15 million, families transfer substantial wealth across generations without repeated estate taxes (Palm City Lawyer).

When Should You Hire Professional Tax Help?

Personal representatives benefit from professional guidance in these situations:

- Estate value approaches or exceeds $15 million

- Complex assets require professional valuation (businesses, art, real estate)

- Decedent owned property in multiple states

- Family disputes exist over asset distribution

- Decedent made significant lifetime gifts

- Portability election is needed

- Estate generates ongoing income

A coordinated approach between a Florida probate attorney and experienced CPA reduces audit risk, maximizes deductions, and ensures all deadlines are met.

Frequently Asked Questions

1. Does Florida have an estate tax?

No. Florida does not have a state estate tax or inheritance tax. The Florida Constitution prohibits these taxes. Florida residents only face potential federal estate taxes if their estate exceeds the federal exemption threshold ($13.99 million in 2025, $15 million in 2026).

2. What is the federal estate tax exemption for 2026?

The federal estate tax exemption increases to $15 million per individual ($30 million for married couples) effective January 1, 2026, under the One Big Beautiful Bill Act. This exemption is now permanent and indexed for inflation starting in 2027.

3. When is Form 706 due for a Florida estate?

Form 706 is due 9 months after the date of death. Personal representatives may request a 6-month extension using Form 4768, making the extended deadline 15 months after death. The extension to file does not extend the time to pay taxes due.

4. Do I need to file Form 1041 for an estate in Florida?

You must file Form 1041 if the estate earns more than $600 in gross income after the date of death. This income includes interest, dividends, rental income, and capital gains from asset sales during estate administration.

5. What is step-up in basis and how does it save taxes?

Step-up in basis adjusts the cost basis of certain inherited assets to their fair market value at the date of death. This eliminates capital gains taxes on appreciation during the decedent’s lifetime. Heirs only pay capital gains tax on appreciation occurring after they inherit the asset.

6. How do I elect portability of the deceased spouse’s exemption?

To elect portability, file Form 706 for the deceased spouse’s estate even if no estate tax is owed. The return must be filed timely (within 9 months or 15 months with extension). Estates below the filing threshold have up to 5 years to make the election under Revenue Procedure 2022-32.

7. What happens if I miss the Form 706 deadline?

Missing the Form 706 deadline results in penalties up to 25% of the tax due, plus interest. More significantly, missing the deadline means losing the portability election, which could cost the surviving spouse millions in unused exemption.

8. Are IRA and 401(k) accounts subject to estate tax?

Yes. Retirement accounts are included in the gross estate for federal estate tax purposes. Retirement accounts do not receive step-up in basis. Beneficiaries pay ordinary income tax on distributions rather than capital gains tax.

9. Do I need a tax professional for a Florida probate estate?

Professional help is recommended for estates with complex assets, values approaching the federal exemption, property in multiple states, or when portability elections are needed. The cost of professional guidance is typically far less than penalties and missed deductions from errors.

10. How long does an estate stay open for tax purposes?

An estate remains open until all assets are distributed and final tax returns are filed. Simple estates close within 8-12 months. Complex estates with disputes, audits, or Form 706 requirements can remain open for 2-5 years or longer. The IRS requests an explanation if a Form 1041 shows the estate has been open more than 2 years.

Action Steps for Personal Representatives

Take these steps to stay on track with tax obligations:

- Week 1: Order 10+ certified death certificates and apply for an EIN

- Month 1: Gather all financial statements, prior tax returns, and asset documentation

- Month 2: Engage qualified appraisers for real estate, businesses, and collectibles

- Month 3: Complete preliminary estate inventory with values as of date of death

- Month 6: Review with attorney and CPA to determine Form 706 filing requirement

- Month 8: If Form 706 needed, file or request extension before 9-month deadline

- April 15: File decedent’s final Form 1040

- Throughout: Track all estate income for Form 1041 filing

Protecting Your Family Is a Phone Call Away

Navigating tax obligations for a large Florida estate requires careful attention to deadlines, valuations, and elections. A single missed deadline or overlooked filing creates penalties that cost thousands of dollars.

The estate planning attorneys at SJF Law Group guide families through probate tax obligations and help minimize tax burdens through strategic planning. When you work with our team, you receive clear guidance on Form 706 requirements, portability elections, and coordination with tax professionals.

Call us at 954-580-3690 or email info@estateandprobatelawyer.com today.