Our Florida estate planning and probate attorneys understand how confusing estate planning concepts can be. That’s why our attorneys take the time to explain difficult concepts, like “step up in basis” to our clients in plain language.

Taxes can be a complicated topic, without question. Taxes, like death, may not be the most pleasant subject, but it is one that is necessary to understand for estate planning purposes.

Why?

Because taxes can eat up a significant portion of your estate. A good estate plan drafted by an experienced estate and probate attorney can help reduce or avoid them.

Which is why, in today’s post, we’re talking taxes. Specifically, we’re going to explain the concept of “step up in basis” in Florida probate, how it affects heirs, and what has changed with the Florida Community Property Trust Act.

What is Capital Gains Tax?

To fully understand the benefit of a step up in basis, you first need to know a little bit about capital gains tax.

When you sell something that has gone up in value over time, the difference between what you bought it for and what you sell it for is considered a capital gain. For example, if you bought stock for $100 and later sell it for $150, the $50 difference is a capital gain.

Capital gains are the profits you realize when you sell an asset like stocks, bonds, or real property. A capital gains tax is triggered only when you sell the asset.

The length of time you hold the asset determines the rate of tax:

- Short-term capital gains (held less than one year) are taxed at your ordinary income tax rate.

- Long-term capital gains (held more than one year) are taxed at 0% to 20%.

Florida does not impose a state income tax, a state inheritance tax, or a state estate tax. This means individuals in Florida do not pay state inheritance, estate, or capital gains tax. However, federal capital gains tax still applies to inherited assets when sold, unless the basis has been “stepped up.”

What is a “Step Up in Basis” and How Does It Affect Your Estate?

In estate planning, a “step up in basis” is a tax feature used to reduce or avoid capital gains tax when passing an asset on to heirs.

Generally speaking, when an asset is passed on to a person’s heirs, its value at the time of inheritance is usually more than when it was originally purchased. So, for example, stock purchased at $100 might be worth $150 by the time it is passed on to a decedent’s heirs.

Ordinarily this would mean that the person inheriting would have to pay capital gains tax when they sell. But when a person dies, his/her assets get a brand-new tax basis equal to the fair market value at the date of the decedent’s death (referred to as the “date of death fair market value”).

This allows his/her heirs to receive a basis in inherited property that is equal to its “date of death fair market value.” This “steps up” the asset’s value to what it is worth as of the date of decedent’s death—thereby avoiding capital gains tax on the appreciation that occurred before the decedent’s passing when the beneficiary later sells.

So, using our example above of stock purchase, this “step up in basis” allows decedent’s heirs to receive decedent’s stock at a brand-new tax basis of $150. When they sell the stock (assuming they sell before it increases in value), they don’t pay any tax.

For married couples, at the time of the death of the first spouse, the surviving spouse is entitled to a step-up in tax basis for ½ of any asset that the couples owned. Florida’s recent Community Property Trust Act (CPTA) may allow Floridians who properly create a Community Property Trust (CPT) to take advantage of the “double step up in basis enjoyed by couples in community property states. In a properly created CPT, at the death of the first spouse, all assets owned by the CPT may receive a new basis equal to the fair market value including the surviving spouse’s ½ interest.

Which Assets Qualify (and Which Do Not)

Assets that typically qualify for step up:

- Real estate

- Stocks, bonds, and other investments in taxable accounts

Assets that usually do not qualify:

- IRAs, 401(k)s, and other retirement accounts

- Assets gifted during life (they carry over the giver’s basis instead of being stepped up)

Florida’s Community Property Trust Act – A Game Changer

What is the FCPT / CPTA?

Florida’s Community Property Trust Act (effective July 1, 2021) allows married couples to create a Florida Community Property Trust which can treat trust assets as community property under Florida law. (The Florida Bar)

Why It Matters

In common-law states (like Florida outside of this trust mechanism), when the first spouse dies, usually only the decedent’s share of jointly held or titled property receives a step-up in basis. The surviving spouse’s share does not generally get stepped up under those usual title forms.

But under a properly created FCPT, all the trust assets may receive a step-up (including the surviving spouse’s share) at the first spouse’s death—this is often called a “double step-up”. (Jones Foster)

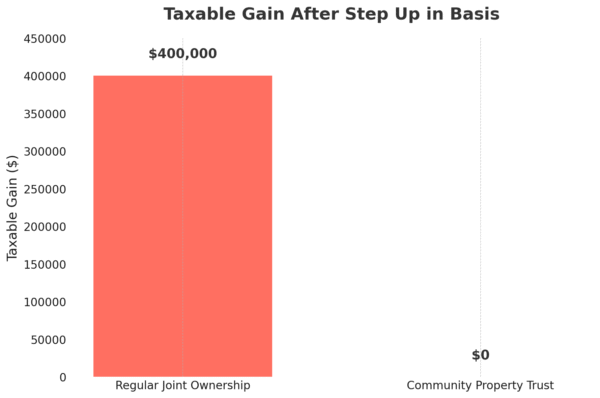

Single vs Double Step-Up: Example

| Scenario | Asset Value at First Spouse’s Death | Original Cost Basis | Who Gets Stepped Up Basis | Taxable Gain if Sold Immediately After Death |

| Regular Ownership / Joint Tenancy | $1,000,000 | $200,000 | Only first spouse’s half gets stepped up → new basis may be around $600,000 (half stepped up) | Gain would be $400,000 (value minus new basis) |

| With FCPT (Community Property Trust) | $1,000,000 | $200,000 | Both spouses’ interests get stepped up → full basis = $1,000,000 | Gain would be $0 (if sold immediately after death) |

This illustrates how much capital gains tax can be avoided if the double step-up is allowed.

Risks and Uncertainties

- Although the Florida law is clear about allowing FCPTs, no definitive IRS ruling or case law has settled all situations. It’s possible the IRS might challenge whether an FCPT qualifies for a double step-up in certain circumstances. (Jones Foster)

- Some assets may be more difficult to include (non-Florida property, certain intangible assets, trust issues).

- There can be other trade-offs: creditor exposure, effect in divorce, how the asset is titled or funded, homestead or other state protections. (Gould Cooksey Fennell)

How to Create / Use a Florida Community Property Trust

If you think this might help you, here are steps and considerations:

- Create the trust in writing, signed by both spouses.

- The trust must declare itself a community property trust under Florida law. (Jones Foster)

- Appoint a qualified trustee (could be one of the spouses in many cases).

- Fund the trust with the assets you want included (you may need to transfer title).

- Maintain proper records and valuation (so fair market value at death can be documented).

- Coordinate with your estate planning attorney & tax advisor to ensure other documents (wills, trusts) match up.

What Happens If You Don’t Use FCPT

- You still get a step-up in basis on inherited assets at death—it’s just that in many typical situations, only part of the property (the decedent’s share) gets stepped up.

- If you gift property during life, that usually does not trigger a step up in basis.

If assets are held in certain trusts, the rules may vary.

Practical Steps You Should Take

- Inventory your assets: real estate, investment accounts, personal property.

- Determine the cost basis for each (what you paid, improvements, etc.).

- Consult with an estate planning lawyer / tax attorney about whether a FCPT makes sense for your situation.

- If deciding to use an FCPT, begin early: creating/funding the trust well before any expected health issues or death helps with clean documentation.

- Regular reviews: tax law proposals occasionally include changes to basis rules, so stay current.

Frequently Asked Questions (FAQs)

- Does a step up in basis apply to retirement accounts like IRAs or 401(l) accounts?

No. Retirement accounts such as IRAs and 401(k)s are taxed differently. Instead of receiving a step up in basis, they are taxed as ordinary income when withdrawals are made by heirs. - What is the Florida Community Property Trust Act?

The Florida Community Property Trust Act, effective July 1, 2021, allows married couples to place assets into a Community Property Trust. Assets in the trust may qualify for a double step up in basis when the first spouse dies. - What are the requirements to create an FCPT?

To create a valid FCPT, both spouses must sign the trust agreement, it must clearly state that it is a Community Property Trust, a qualified trustee must be appointed, and assets must be properly transferred into the trust. - What is the difference between a single and double step up?

In a single step up, only the deceased spouse’s share of property is reset to fair market value. In a double step up, potentially available with an FCPT, both the deceased spouse’s and surviving spouse’s shares receive a new basis. - Could the IRS disallow a double step up?

There is some uncertainty. While Florida law supports it, the IRS has not issued definitive rulings in every scenario. Some tax professionals caution that a challenge is possible. - How does gifting compare to inheritance for tax basis?

If you gift an asset during your lifetime, the recipient takes your original cost basis. If the asset is inherited at death, the heir usually receives a step up in basis to fair market value, which is often more favorable. - How is the fair market value determined at death?

Fair market value is established using professional appraisals for real estate and official valuations for securities, investments, and other property as of the date of death. - What does it cost to set up an FCPT?

The cost varies depending on the complexity of your estate and the attorney’s fees. Expenses usually include legal drafting, trustee arrangements, and transferring assets into the trust. - Does an FCPT affect creditor or divorce claims?

Yes. Because community property is jointly owned, it may affect how property is divided in divorce or exposed to creditors. This is why legal advice is essential before creating the trust. - Are there proposed federal changes to step up rules?

Yes. Lawmakers have proposed limiting or eliminating step up in basis for high-value estates. None of these proposals have passed yet, but monitoring federal tax law changes is important.

Need Help with Your Estate Planning? Protecting Your Family is Just a Phone Call Away.

Our team here at SJF Law Group works hard to ensure that your wishes will be followed, and your loved ones taken care of when you are gone. Our estate planning lawyers expertly guide individuals and families through the complex probate process and capably handle all aspects of the creation, administration, and settlement of estates and trusts. When you work with our Florida estate planning attorneys at SJF Law Group, you get more than just an estate plan: you get peace of mind.

As trusted estate planning lawyers, we serve clients in the vibrant communities of Plantation, Fort Lauderdale, Boca Raton, West Palm Beach, and Miami, FL. We are also pleased to offer the options of both in-person and virtual appointments throughout Florida to make our services accessible no matter where you are located.

If you want to discuss your specific situations with one of our estate planning lawyers, do not hesitate to reach out to our law firm at 954-580-3690. You can also fill out our contact form.